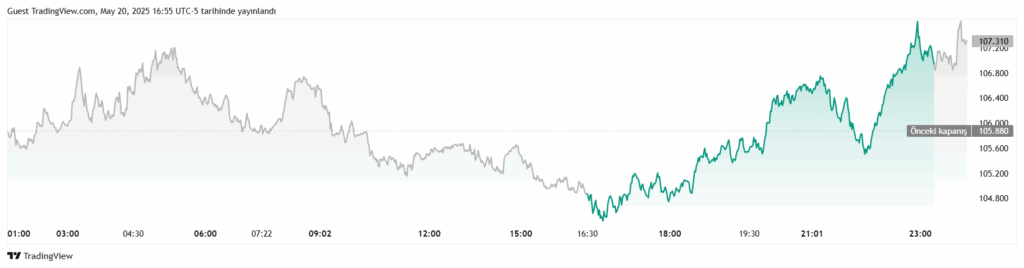

Bitcoin futures open interest has reached $72 billion. This indicates increased leverage use by institutional investors. The Chicago Mercantile Exchange (CME) leads with $16.9 billion in open interest, followed by Binance with $12 billion. According to CoinGlass data, short positions worth $1.2 billion in the $107,000-$108,000 range face liquidation risk. This strengthens Bitcoin’s potential to reach new highs. Rising institutional demand supports market optimism. However, BTC inability to break the $107,000 level since May 18 is noteworthy.

The volume of leveraged positions could drive BTC to an all-time high. In particular, concerns about U.S. fiscal debt are fueling this rise. Disagreements between Democratic and Republican lawmakers are increasing economic uncertainty. Yields on 20-year U.S. Treasury bonds are hovering near 5%, up from 4.82%. Weak demand is pushing the U.S. Federal Reserve to intervene directly in the market. This weakens the U.S. dollar, driving investors toward alternative assets like Bitcoin.

Gold Dominates, Bitcoin Shines in Reserve Allocations

Gold continues to lead among alternative assets. However, with a 24% gain in 2025 and a $22 trillion market cap, it’s becoming less attractive to some investors. For comparison, the S&P 500 is valued at $53 trillion, and U.S. bank deposits stand at $18.6 trillion. Bitcoin, on the other hand, forms a $2.1 trillion asset class, comparable to silver.

Some countries plan to shift 5% of their gold reserves to Bitcoin. This move could generate approximately $105 billion in new market inflows, equivalent to 1 million BTC at a price of $105,000 per BTC. For instance, Michael Saylor’s Strategy company currently holds 576,230 BTC. As institutional investors buy Bitcoin, breaking the $108,000 level becomes feasible. When the rally begins, investors close short positions, pushing prices to new record highs. On the other hand, macroeconomic uncertainties reduce investor sentiment and dampen market risk appetite.

Bitcoin is approaching the $107,000 threshold. Short positions face the risk of forced liquidation. Investors are preparing for BTC bull run. Closely monitoring the market is critical.

NOT INVESTMENT ADVICE

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.