Nearly 47,000 Bitcoin options contracts, worth around $5.1 billion, are set to expire on Friday, October 24. While this expiry is slightly larger than last week’s, analysts expect limited impact on spot Bitcoin prices, which have traded mostly sideways in recent sessions. However, the U.S. government shutdown and the delayed September CPI report could add volatility if inflation exceeds the expected 3.1%, potentially triggering short-term price swings across crypto markets.

Open Interest Hits Record High on Deribit

This week’s put/call ratio for Bitcoin options stands at 1.03, showing a near balance between bullish and bearish bets. According to Coinglass, the max pain point—where most options expire worthless—is around $114,000. Open interest remains heavily concentrated between $120,000 and $140,000, while short-term sellers have placed over $2 billion in positions near $100,000.

Across all exchanges, total BTC options open interest has surged to a record $63 billion, with Deribit alone accounting for $50 billion. “The derivatives structure appears to be shifting from high leverage toward hedging,” noted Greeks Live, adding that many investors are frustrated by Bitcoin’s underperformance compared to gold and equities.

The recent AWS outage also briefly disrupted Coinbase trading, making it harder for institutions to execute large orders during this critical expiry period.

Ethereum Options Add to Expiry Pressure

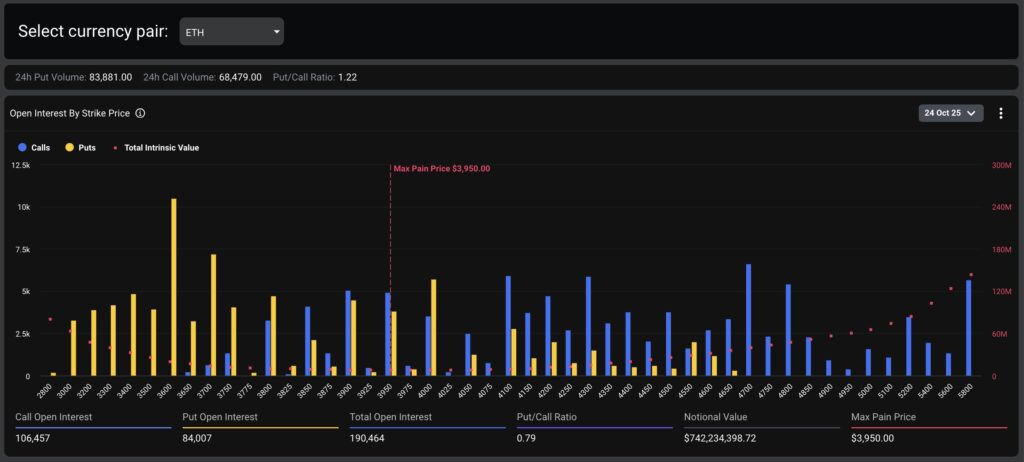

Alongside Bitcoin, around 193,000 Ethereum options contracts, valued at roughly $749 million, are also expiring today. The max pain level for ETH options sits near $3,950, with a put/call ratio of 0.78, suggesting a slightly bullish bias. Total Ethereum open interest now exceeds $15 billion, bringing the combined crypto options expiry value to nearly $5.8 billion.

Spot Market Outlook: Limited Reaction Expected

Meanwhile, the global crypto market cap has risen 1.8% in the past 24 hours to $3.8 trillion. Bitcoin (BTC) briefly climbed above $111,000 late Thursday before pulling back slightly on Friday morning, while Ethereum (ETH), Solana (SOL), and BNB posted solid gains.

Analysts expect Bitcoin to consolidate between $110,000 and $114,000 following today’s expiry as traders await macroeconomic cues and liquidity shifts to define the next major move.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.