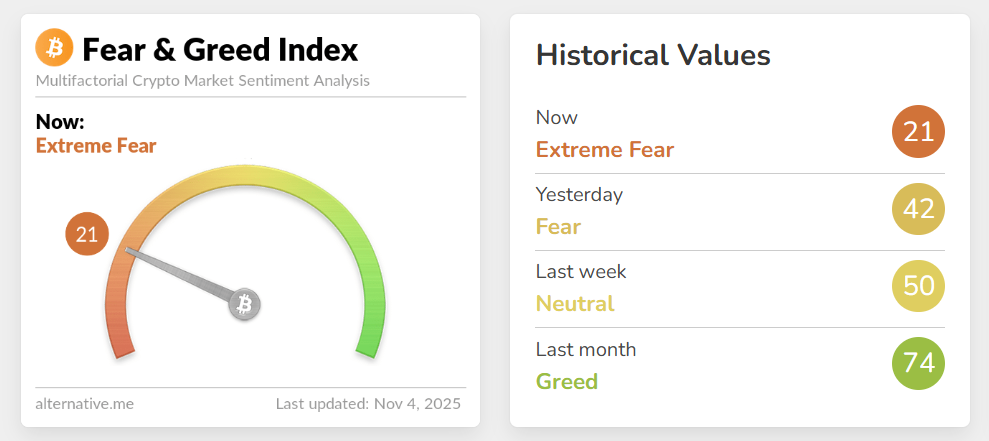

Bitcoin price drop below $106,000 triggered a sharp shift in crypto market sentiment, pushing the Fear and Greed Index down to 21 — its lowest level in nearly seven months. Investor confidence weakened as panic and uncertainty increased across the market.

Bitcoin Falls Below $106K, Market Sentiment Collapses

Bitcoin slipped from a daily high above $109,000 on Monday to a 24-hour low of $105,540. According to CoinGecko, BTC is now hovering just above $106,500 after briefly touching $104,497. This Bitcoin price drop has intensified fear among investors and raised concerns about further declines in the crypto market.

The Crypto Fear and Greed Index fell by nearly 50% in one day, signaling “Extreme Fear.” Analysts link the current downturn to weaker institutional demand, slowing blockchain activity and growing uncertainty over the U.S. Federal Reserve’s policy stance.

Why Investors Are in ‘Extreme Fear’

Several factors contributed to the negative sentiment:

-

Over $800 million in net outflows from Bitcoin-linked ETFs last week

-

Institutional buying fell below daily mining supply for the first time in seven months

-

Fed cut interest rates for the second time this year but signaled no clear plan for future cuts

-

Risk appetite declined amid global economic concerns and market stress

As a result, some investors rushed to exit positions, while others view this dip as a potential accumulation zone.

What Is ‘Moonvember’ and Is It Still Possible?

“Moonvember” is a term used in the crypto community to describe Bitcoin’s historical trend of strong gains in November — often exceeding 40% on average. Investors expect BTC to “go to the moon” during this month. However, with market sentiment in extreme fear and confidence fading, optimism around Moonvember is now more cautious and uncertain.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.