Bitcoin recent price drop signals a clear decline in investor confidence. After recording an all-time high of $122,054 on July 14, BTC has struggled to maintain its upward momentum. At press time, the leading cryptocurrency trades near $113,400, marking a 7.4% decline in just 19 days.

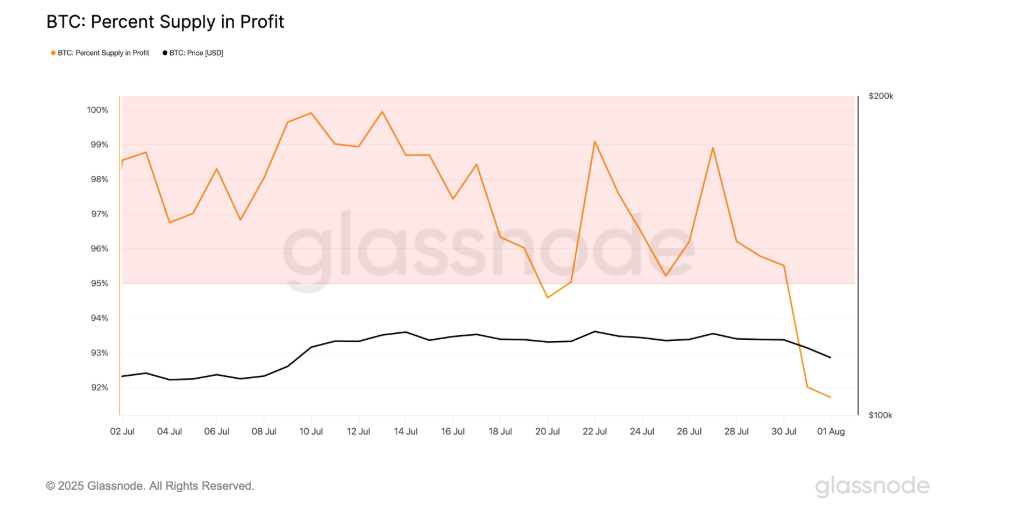

This price action has also impacted the share of BTC supply held in profit. According to Glassnode, as of August 1, Bitcoin’s supply in profit dropped to 91.71%, the lowest level in 41 days. This metric indicates what percentage of circulating BTC is currently held above acquisition cost.

Historically, a decline in this metric reflects weakening market sentiment. Fewer holders remain in profit, which can increase selling pressure. As a result, short-term corrections in BTC’s price become more likely.

Long/Short Ratio Falls: Leverage Traders Pull Back

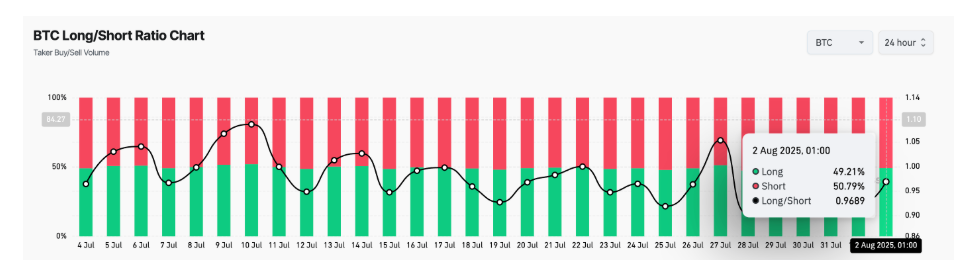

The derivatives market also shows signs of reduced bullish sentiment. BTC’s long/short ratio has dropped to 0.96, falling below the key 1.0 threshold. This ratio compares the number of long positions to short ones. A figure below 1 suggests more traders are betting on a price decline than a rise.

At the same time, the decrease in long exposure creates room for downward movement. Unless a new bullish catalyst emerges, BTC may struggle to regain upward momentum.

Additionally, trading volume has significantly decreased. Daily volume, which peaked during July’s rally, is now showing signs of weakening market participation. The combination of weaker demand and rising profit-taking strengthens the bearish short-term outlook.

Which Levels Could Bitcoin Test Next?

Based on current technical indicators, Bitcoin could test the $111,855 support zone in the short term. This level is viewed as a key threshold by many market participants. If buyer interest strengthens here, BTC could recover toward $116,952.

Meanwhile, $120,000 remains a critical resistance level for bullish continuation. Breaking through this zone may rebuild investor confidence and trigger fresh momentum. However, this would require an uptick in trading volume and a visible shift in market sentiment.

Moreover, upcoming macroeconomic developments and possible ETF-related news could act as external catalysts. For now, caution dominates BTC’s short-term outlook.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.