Capital Group is making waves with its strategic Bitcoin investments. The firm transformed a $1 billion position into $6 billion through Strategy and Metaplanet shares. This move positions the investment giant as a major example in the crypto market.

Capital Group’s Bitcoin Strategy

Instead of buying Bitcoin directly, Capital Group prefers Bitcoin treasury companies. These firms accumulate BTC on their balance sheets, giving institutional investors indirect exposure. Moreover, Capital Group’s portfolio manager, Mark Casey, cites Benjamin Graham and Warren Buffett as key influences on his investment approach.

Casey treats Bitcoin as a commodity and structures the portfolio accordingly. Capital Group stands out with its 12.3% stake in Strategy (formerly MicroStrategy). This investment is now worth about $6.2 billion thanks to the stock’s significant value increase. Additionally, Capital Group holds positions in Metaplanet and Mara Holdings, further diversifying its BTC exposure.

Strategy and Metaplanet Investments

Strategy transformed from a software company into a BTC-focused firm under Michael Saylor’s leadership. The company currently holds 636,505 BTC on its balance sheet. Capital Group’s $500+ million investment gives it a significant share in Strategy.

Additionally, the firm acquired 5% of Japan-based Metaplanet, enhancing portfolio diversification. Shares in mining company Mara Holdings further strengthen Capital Group’s corporate Bitcoin exposure. By investing across multiple BTC-focused sectors, the firm spreads its risk effectively.

Corporate Bitcoin Treasuries and Future Trends

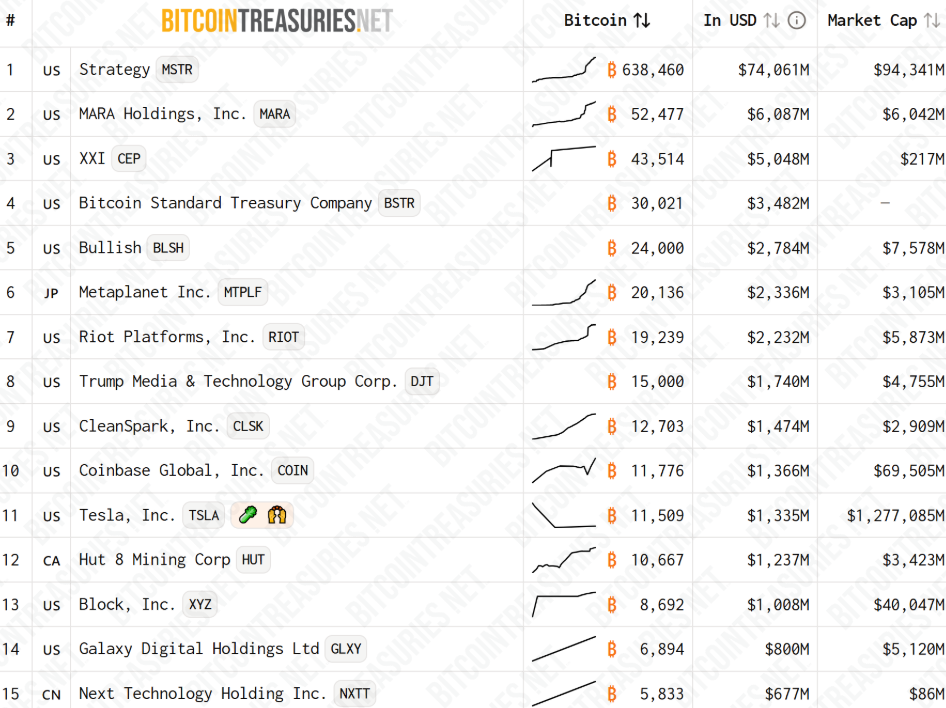

Currently, corporate treasuries hold over 1 million BTC, worth roughly $117 billion. Strategy remains the largest Bitcoin holder, while Mara Holdings and other firms are growing rapidly.

Looking ahead, companies like Metaplanet and Semler Scientific plan aggressive Bitcoin accumulation. Metaplanet targets 210,000 BTC, and Semler Scientific aims for 105,000 BTC, signaling continued institutional interest in BTC.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates