Adam Back, the CEO of Blockstream, believes that Bitcoin-focused treasury companies are leading the way toward a $200 trillion market capitalization by accelerating global Bitcoin adoption.

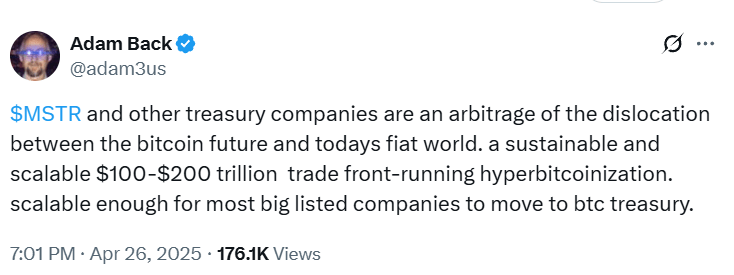

Institutions and governments worldwide are beginning to recognize the unique monetary properties of Bitcoin (BTC). On April 26, Back shared the following post on X:

“MSTR and other treasury companies are arbitraging the dislocation between Bitcoin’s future and today’s fiat world. This is a sustainable and scalable $100-200 trillion trade.”

Hyperbitcoinization refers to the theoretical future where Bitcoin becomes the dominant global currency, replacing fiat due to inflation and a growing distrust in traditional financial systems.

Bitcoin’s Price Outpacing Inflation

Back emphasizes that Bitcoin’s price consistently outpaces inflation and interest rates over four-year periods, fueling global hyperbitcoinization:

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

“Some believe treasury strategy is a temporary glitch. I say no — it is a logical and sustainable arbitrage. But not forever; the main driver is Bitcoin price outperforming interest and inflation every four years.”

Nearly two months ago, U.S. President Donald Trump signed an executive order to create a national Bitcoin reserve using BTC forfeited in criminal cases. This has further boosted Bitcoin’s recognition at the governmental level.

Global Firms Continue Accumulating Bitcoin!

The Bitcoin accumulation trend is not limited to the United States. Strategy, currently the largest corporate Bitcoin holder, has reportedly generated over $5.1 billion in profit from its Bitcoin treasury since early 2025, according to co-founder Michael Saylor.

Meanwhile, Japanese investment firm Metaplanet, often referred to as “Asia’s MicroStrategy,” surpassed 5,000 BTC holdings as of April 24. The company aims to acquire 21,000 BTC by 2026.

Confidence among U.S. financial institutions is also increasing. The Federal Reserve recently withdrew its 2022 guidance discouraging banks from dealing with cryptocurrencies. Michael Saylor commented:

“Banks are now free to start supporting Bitcoin.”

Nexo analyst Iliya Kalchev told Cointelegraph that banks would now be supervised through normal processes, marking a more open regulatory environment for digital asset integration.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.