According to recent findings from on-chain data tracking platforms, BlackRock, the world’s largest asset manager, has transferred a significant amount of Ethereum (ETH) to its institutional partner, Coinbase Prime, in connection with its iShares Ethereum Trust ETF (ETHA) operations.

This large movement is the latest example of BlackRock’s intense and ongoing institutional activity in the digital asset market.

Technical Details of the Transfer

-

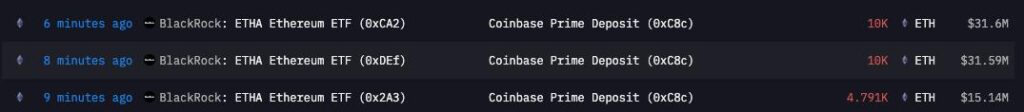

Amount Transferred: 24,791 ETH

-

Approximate Value: $78.3 million (Based on the market price at the time of the transaction)

-

Recipient Platform: Coinbase Prime (Institutional Custody and Trading Arm)

-

Sender Wallet: Wallets labeled as belonging to BlackRock’s iShares Ethereum Trust (ETHA).

Institutional Transfer Analysis: Selling Pressure or Liquidity Management?

While large transfers often trigger panic in the crypto market, this move by BlackRock is highly likely related to routine ETF liquidity and operational management.

-

Response to Redemption: BlackRock’s spot ETFs (Bitcoin and Ethereum) trade like stocks. When investors redeem their shares, BlackRock is required to sell or reallocate the corresponding crypto assets held by the fund. This ETH is sent to Coinbase Prime, which provides institutional-grade trading and settlement services, for this purpose. While this situation has the potential to create selling pressure in the market, it is not a direct guarantee of a sales order.

-

Operational Necessity: Coinbase Prime serves as the primary custodian and broker for giants like BlackRock’s ETFs. All major asset movements must take place through this institutional platform. This is a standard procedure in BlackRock’s process of managing billions of dollars in ETH assets.

ETHA’s Market Impact and Future Speculations

Following the success of its Bitcoin ETF (IBIT), BlackRock launched ETHA, which quickly reached billions of dollars in Assets Under Management (AUM), becoming one of the largest institutional players in the Ethereum market. The period in which the transfer occurred coincides with a sensitive time when the price of ETH is trying to hold a specific support level, making this movement closely monitored.

Additionally, the possibility of BlackRock integrating Ethereum Staking into the ETHA structure is a constantly discussed topic in the market. Such large transfers could also indicate operational preparations for this potential yield-enhancing feature in the future.

In summary: This $78.3 million transfer reflects the routine operations within BlackRock’s massive ETF fund; however, due to its size, it is critical data that investors should follow to understand short-term market liquidity.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.