The world’s largest asset manager, BlackRock, plans to bring its successful exchange-traded funds (ETFs) onto the blockchain. According to Bloomberg, this initiative could involve the tokenization of real-world assets (RWAs), including equities.

BlackRock’s ETF Success and Crypto Expansion

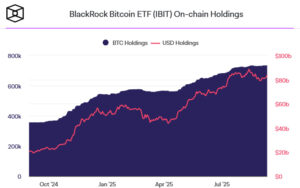

BlackRock’s crypto-based products have quickly achieved significant success. Its iShares Bitcoin Trust and iShares Ethereum Trust funds surpassed $10 billion in assets under management within a year. This indicates that two of the three ETFs in history to reach this milestone belong to BlackRock.

The firm also offers thematic funds like the iShares Blockchain and Tech ETF, which track blockchain companies without directly investing in cryptocurrencies.

Increasing Tokenization on Wall Street

BlackRock’s move comes at a time when tokenization trends are accelerating on Wall Street.

- Fidelity launched a blockchain-based version of its Treasury money market fund this week.

- Nasdaq has applied to the SEC to enable trading of tokenized securities alongside traditional stocks.

Tokenization is expected to enhance efficiency within traditional finance (TradFi) infrastructure.

BlackRock’s Tokenization Experience

BlackRock has already gained experience with tokenized products. In March, it introduced the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), the first tokenized fund to surpass $1 billion in assets, which now manages over $2 billion.

CEO Larry Fink has repeatedly stated that eventually all financial assets will be tokenized. By Q1 2025, BlackRock’s crypto assets under management reached around $50 billion.

Criticism of Tokenization

Bloomberg ETF analyst Eric Balchunas argued that tokenization will not fundamentally change investor behavior. According to him, tokenization is more likely to facilitate back-office operations rather than replace traditional investment funds.

Nevertheless, as institutional interest in digital assets continues to grow, BlackRock’s initiative could mark a significant milestone in the tokenization of real-world assets (RWAs).

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates