Recently, AsterDEX exchange and its native token, Aster Coin (ASTER), have gained attention following posts by Binance founder Changpeng Zhao (CZ). With rising social media interest and increased investor inflows, Aster’s price has achieved notable gains.

As of October 8, 2025, Aster Coin is trading at $2.05, drawing investor attention. But can Aster Coin really reach $4? Many investors believe that CZ’s frequently used “4” symbol carries a symbolic connection to this potential rally. Let’s examine both the technical and fundamental data.

Key Levels According to Technical Analysis

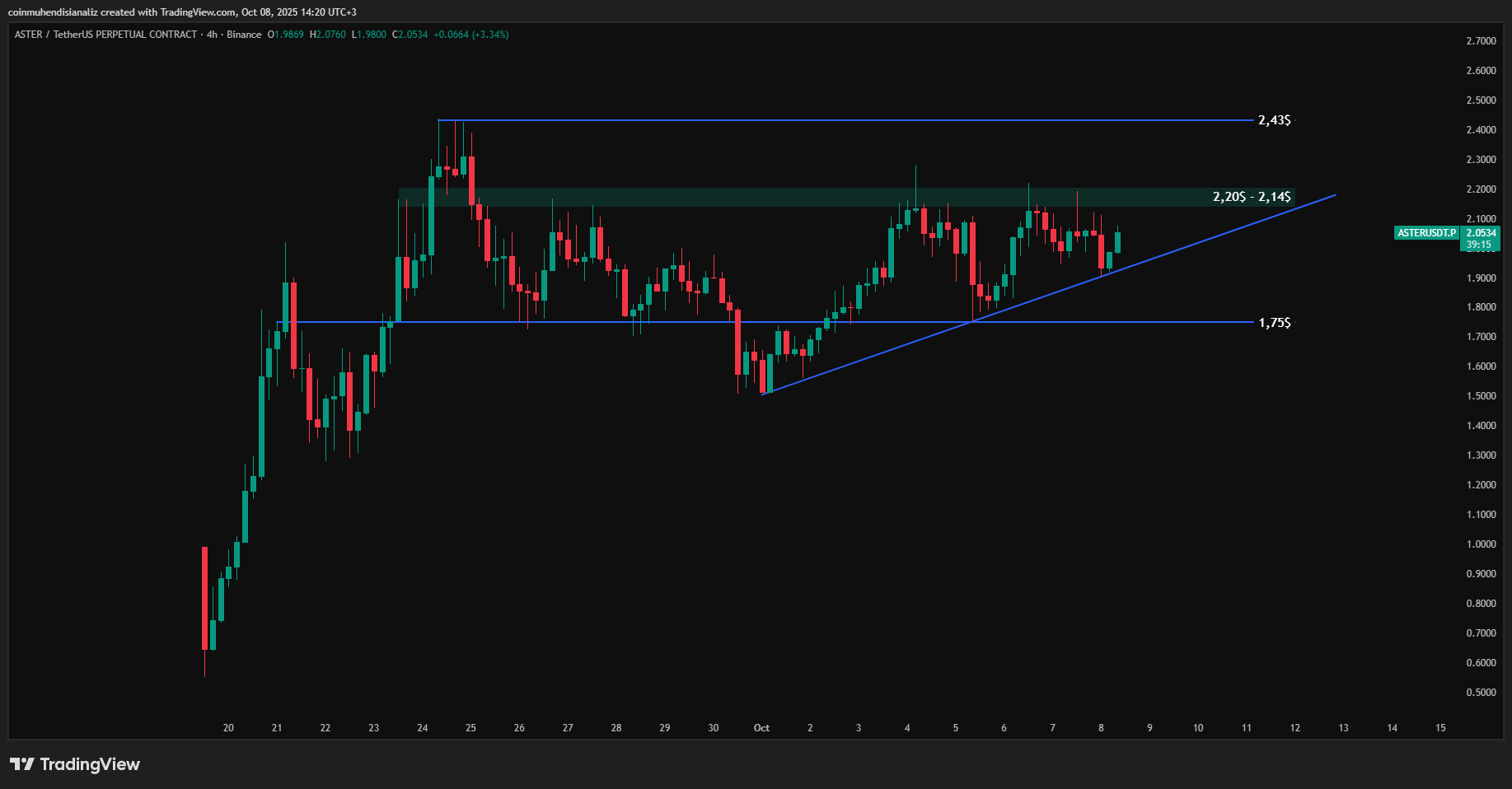

From a technical perspective, Aster Coin has been testing the $2.14–$2.20 resistance zone for a while. A daily close above this level could strengthen expectations for a new all-time high (ATH).

Meanwhile, a minor ascending trend has gradually formed in the price action. If this trend is broken, a short-term pullback to the $1.75 support zone may occur. However, current momentum slightly favors the bullish scenario.

What Does the Fundamental Analysis Say?

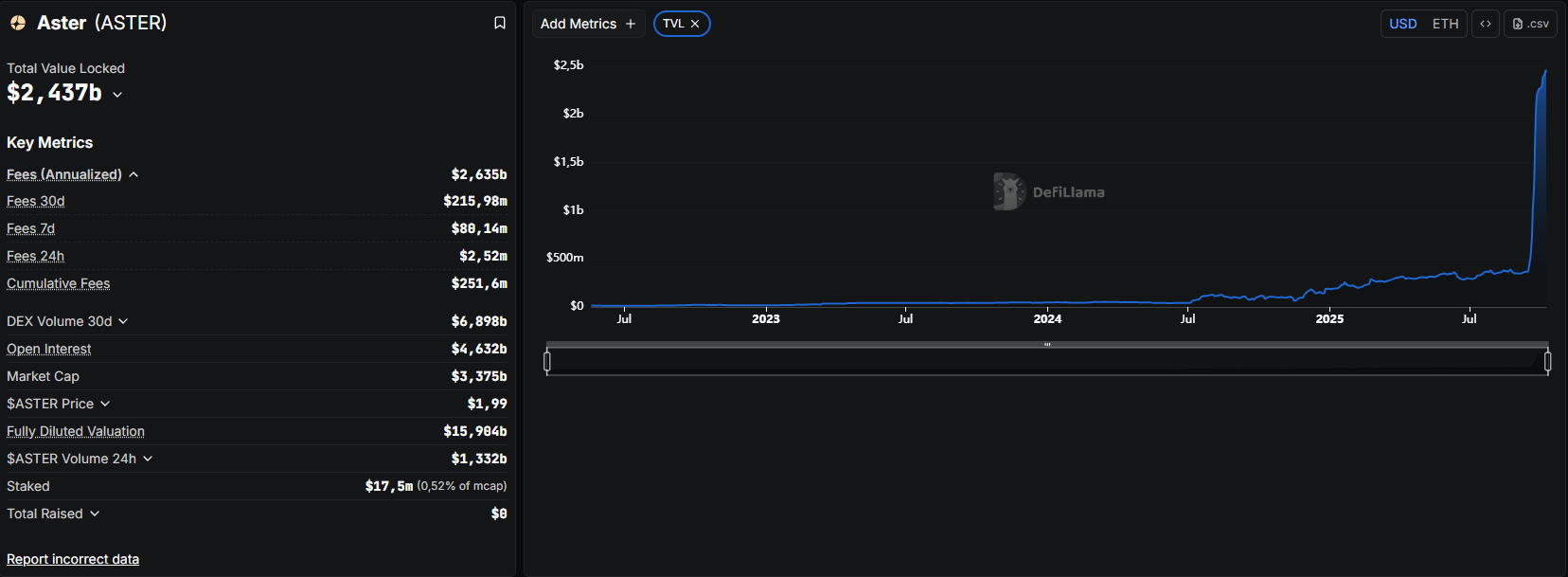

According to current data, AsterDEX has a Total Value Locked (TVL) of $2.43 billion, which stands out as a relatively high level among decentralized exchanges (DEXs).

The project also has a market capitalization of $3.37 billion, meaning that with just a 2x price increase, it could reach $6.7 billion. For a DEX with an average daily futures trading volume of $14–15 billion, many analysts consider this target achievable.

Additionally, the platform collects an average of $2.5 million in daily transaction fees, a key detail that sets AsterDEX apart from its competitors in terms of revenue generation.

So, Can It Really Reach $4?

Aster Coin is showing a strong outlook in both technical and fundamental indicators. In the short term, maintaining support above $2 and breaking through the resistance zone could push the price toward new targets. In the long term, the growth of the ecosystem, stable trading volumes, and sustained investor interest suggest that the $4 target may not be as distant as some think.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.