The long-running debate over Bitcoin role as a store of value has once again taken center stage. Comparisons between Bitcoin and traditional safe-haven assets such as gold and silver continue to divide investors, especially as long-term performance data paints a striking contrast between digital and physical assets.

A Decade of Performance Favors Bitcoin

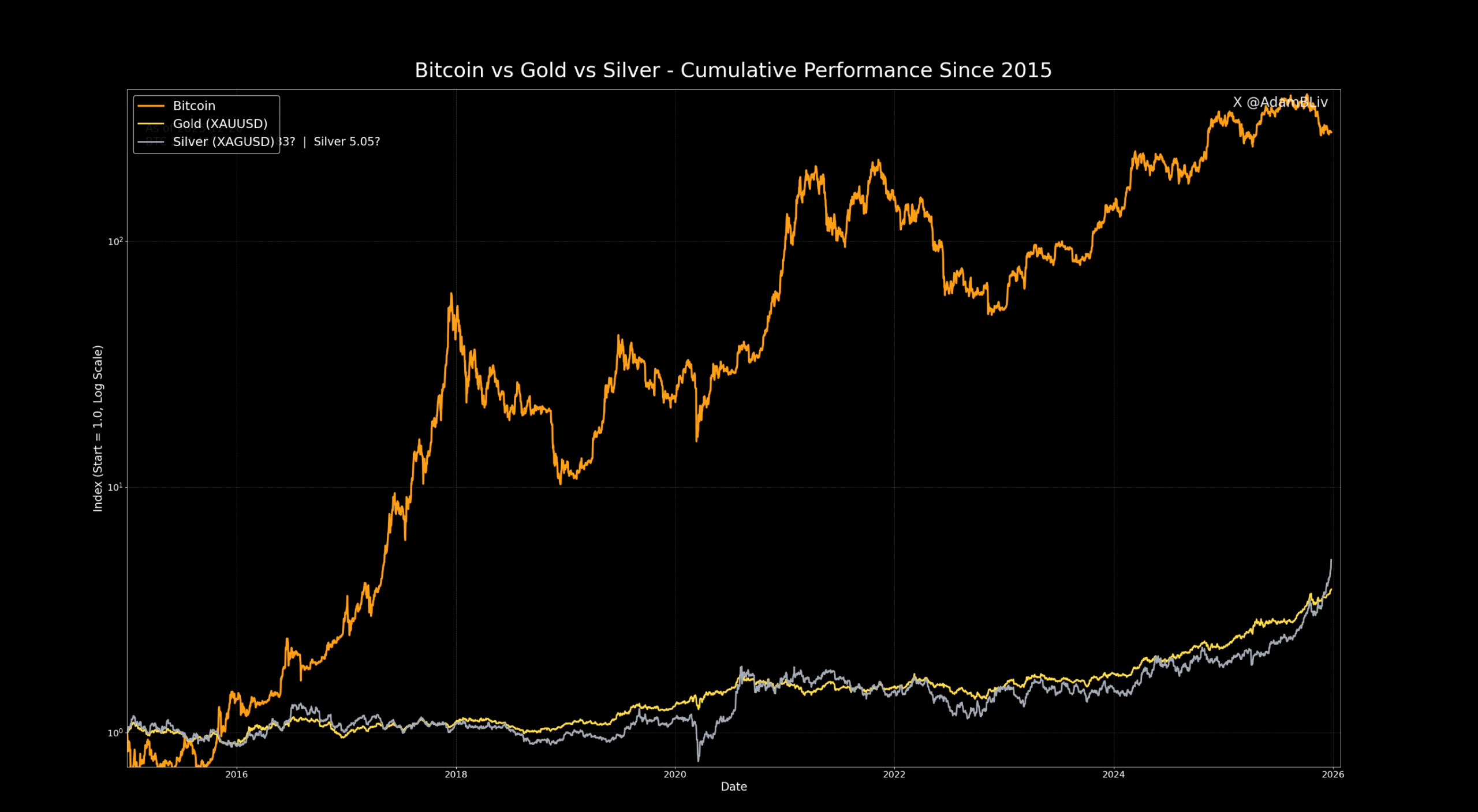

Since 2015, Bitcoin has delivered extraordinary returns, far exceeding those of precious metals. Over the past ten years, Bitcoin has recorded a cumulative gain of approximately 27,701%. During the same period, silver increased by around 405%, while gold rose roughly 283%.

These figures highlight Bitcoin’s aggressive growth profile compared to traditional commodities. Even when critics argue that Bitcoin’s earliest years should be excluded from comparisons, the asset’s long-term outperformance remains difficult to ignore.

Short-Term Critics Question the Comparison

Skeptics of Bitcoin often focus on shorter timeframes, suggesting that recent years provide a more balanced comparison. From this perspective, Bitcoin’s volatility and periods of consolidation are used as evidence that its explosive growth phase may be behind it.

Supporters of this view argue that as Bitcoin matures, its price behavior increasingly resembles that of established financial assets. However, Bitcoin advocates counter that temporary stagnation does not undermine its long-term value proposition as a scarce digital asset.

Supply Mechanics Set Bitcoin Apart

One of the most important distinctions between Bitcoin and precious metals lies in supply dynamics. When gold or silver prices rise, mining activity becomes more profitable, leading to increased production and higher supply. Over time, this mechanism tends to pull prices back toward production costs.

Bitcoin operates under a fundamentally different model. Its total supply is capped, and new issuance follows a predictable and declining schedule. This fixed supply structure limits dilution and creates long-term scarcity, a feature that many investors see as a key advantage over commodities.

A Weakening Dollar Supports Scarce Assets

Macroeconomic conditions are also shaping the debate. The US dollar is on track to end 2025 with its weakest performance in a decade, as the Dollar Index has fallen by nearly 10%. At the same time, accommodative monetary policies and inflation concerns are encouraging investors to seek protection in scarce assets.

In this environment, Bitcoin, gold, and silver all stand to benefit. However, Bitcoin’s historical performance and supply characteristics continue to position it uniquely within the store-of-value conversation.

As global monetary conditions evolve, the comparison between digital and traditional safe havens is likely to intensify. Bitcoin’s long-term track record ensures it will remain a central reference point in that discussion.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.