As blockchain-based financial infrastructure continues to mature, the integration of real-world assets (RWAs) into onchain markets has become a central focus of the industry. Despite significant progress, U.S. equities and ETFs—among the largest and most liquid asset classes globally—have long remained underrepresented onchain due to structural and technical constraints. Chainlink newly announced 24/5 U.S. Equity Data Feeds aim to address this long-standing gap.

The Structural Mismatch Holding Onchain Markets Back

Traditional U.S. equity markets operate within fixed trading sessions, while blockchain networks run continuously without interruption. This fundamental mismatch has created persistent challenges for onchain applications, including pricing gaps, limited visibility outside market hours, and elevated risk during off-session periods. Most existing oracle solutions only provide price data during standard trading hours, which restricts the reliability of DeFi products that are designed to function around the clock.

What the 24/5 Data Feeds Deliver with Chainlink

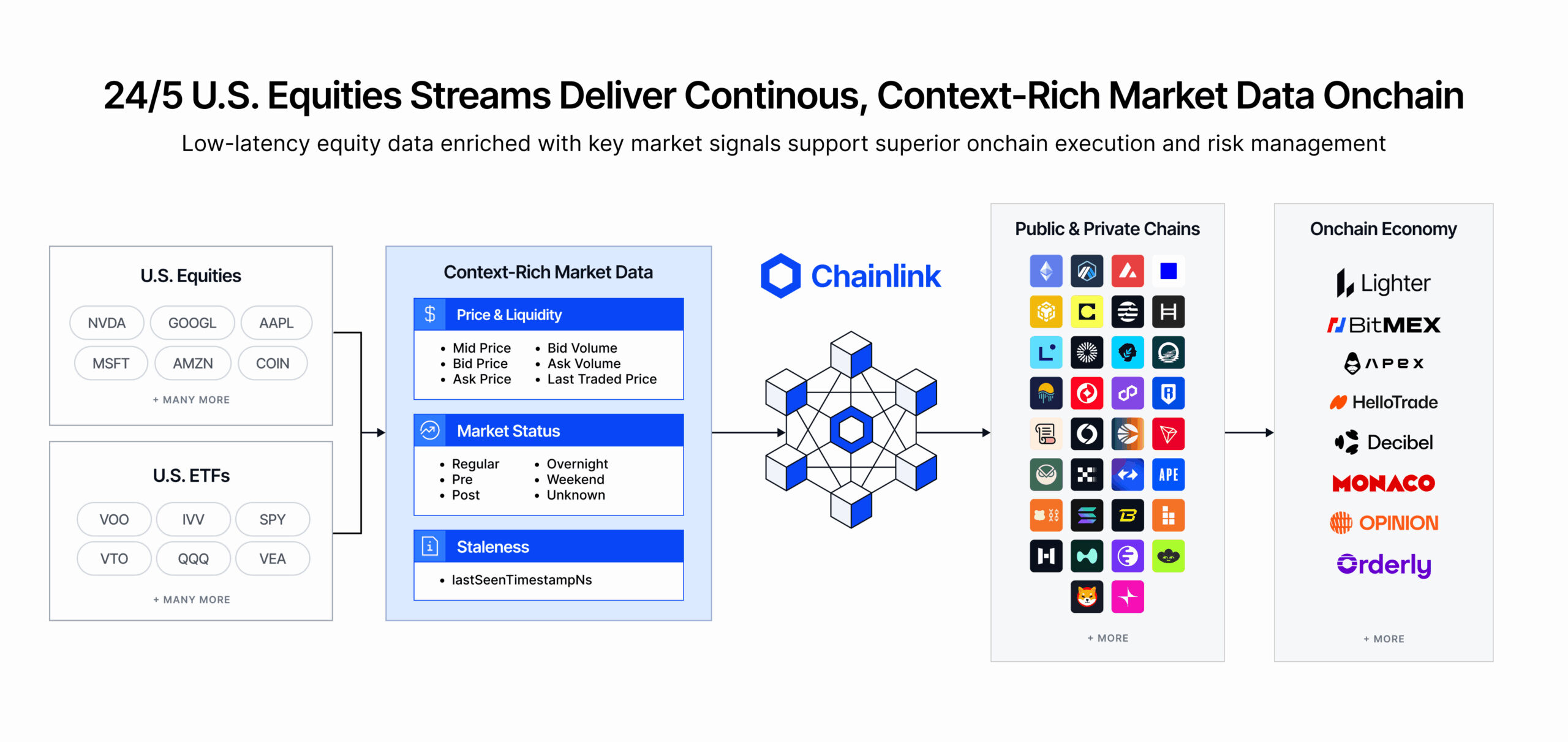

Chainlink’s 24/5 U.S. Equity Data Feeds consolidate fragmented market data into a unified, continuous pricing stream. The feeds cover regular trading hours as well as pre-market, after-hours, and overnight sessions, delivering uninterrupted price information five days a week. As a result, onchain markets can more accurately reflect real-world market conditions across extended trading windows.

Beyond headline prices, the data feeds include a rich set of market indicators such as bid and ask prices, trading volume, mid-price calculations, market status flags, and data freshness indicators. This expanded dataset enables protocols to design more robust risk frameworks and implement liquidation mechanisms that are better aligned with actual market dynamics.

Unlocking New Onchain Financial Products by Chainlink

Access to continuous equity data significantly broadens the scope of onchain financial innovation. Developers can now build U.S. equity-based perpetual contracts, prediction markets, synthetic stock instruments, lending protocols, and structured products with far greater confidence in their pricing inputs. The ability to support trading activity outside traditional market hours is particularly important for attracting global users across multiple time zones.

Growing Institutional Adoption

The new data feeds are already being adopted by leading platforms across the digital asset ecosystem. Major derivatives venues and RWA-focused protocols are leveraging Chainlink’s verifiable and high-frequency data to launch products that operate on a 24/5 basis while meeting institutional-grade reliability standards.

A Step Toward Always-On Capital Markets

Chainlink’s latest announcement represents a meaningful advancement in aligning onchain finance with traditional capital markets. By delivering continuous, high-quality equity data, the infrastructure lays the groundwork for more mature, secure, and accessible onchain equity markets. This development marks a key step toward truly global, always-on capital markets powered by blockchain technology.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.