Sometimes, the quietest signals in the crypto market are the most telling. One such indicator is Bitcoin dominance, which reflects the strength of BTC relative to other cryptocurrencies. Recently, technical structures have turned this metric into a focal point for market analysts.

Order Block Holds, Upside Potential Remains

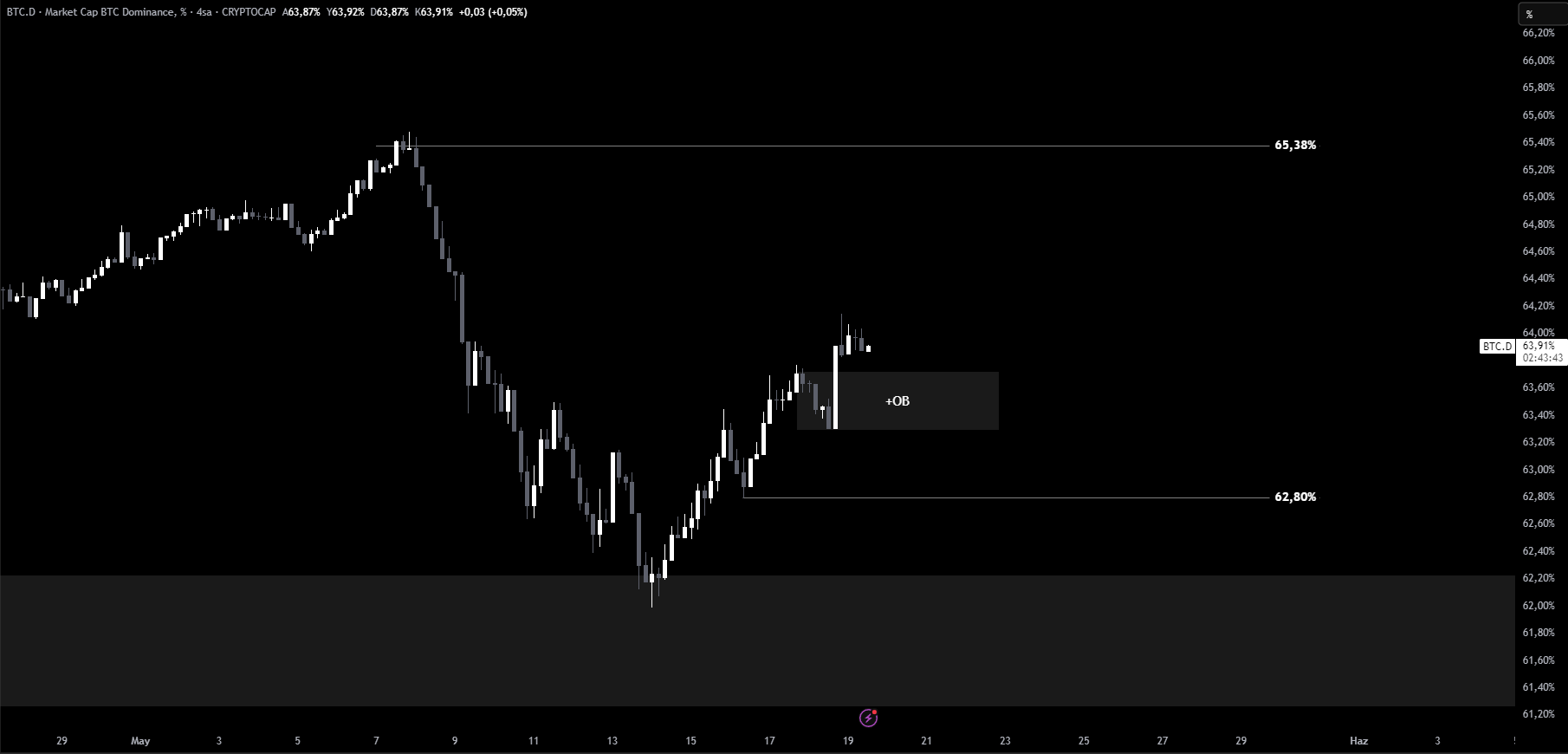

From a technical standpoint, Bitcoin dominance continues to hold above its latest upward Order Block zone. As long as this level is maintained, the metric could rise toward 65.38%, signaling increasing BTC control over the broader market.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Such a scenario may spell trouble for Ethereum and other altcoins, especially if ETH loses its key support level. A dominance surge would likely drain liquidity from the altcoin space, triggering sharp pullbacks.

Losing Support Could Trigger A Decline

Every strong trend has its vulnerabilities. If Bitcoin dominance fails to maintain current support, a drop toward 62.80% becomes more likely. Interestingly, this outcome might actually favor altcoins, providing room for short-term relief or rally.

In either case, the market is approaching a critical juncture. Traders would do well to monitor both technical signals and macro trends closely and reassess their positions accordingly.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.