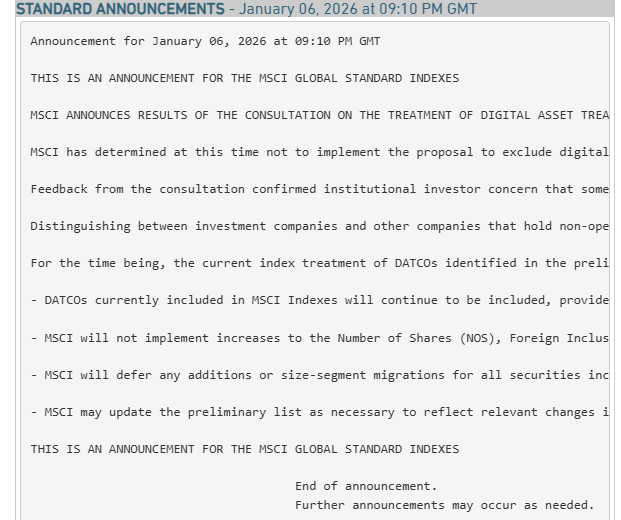

MSCI, closely followed across global financial markets, has announced its long-awaited decision regarding companies that hold a significant portion of crypto assets on their balance sheets. The index provider has postponed the evaluation of whether these companies will be removed from its indexes to a later review in 2026. This decision has temporarily eliminated a major source of uncertainty, especially for companies that use Bitcoin as a treasury asset.

MSCI: Crypto Treasury Companies Remain in the Indexes

With MSCI’s decision, companies holding Bitcoin and other crypto assets on their balance sheets will continue to be included in existing indexes. In this context, the potential exclusion of Bitcoin-focused treasury companies such as Strategy (formerly MicroStrategy), led by Michael Saylor, has been taken off the table for now.

Market reaction followed quickly after the announcement. Strategy shares rose by approximately 6% in after-hours trading. This move indicates that investors viewed the MSCI decision as a clearly positive development for these companies.

![]()

What Is MSCI and Why Is It Critical for Markets?

MSCI (Morgan Stanley Capital International) is considered one of the most influential index providers on a global scale. In addition to classifying countries as Developed, Emerging, and Frontier Markets, it creates broad market indexes such as MSCI World, MSCI Emerging Markets, and MSCI USA.

The importance of these indexes goes far beyond serving as simple benchmarks. ETFs, pension funds, and passive investment funds managing trillions of dollars structure their portfolios directly based on MSCI indexes. As a result, when a company is removed from an MSCI index, these funds are forced to automatically sell the related shares. This can create significant selling pressure in a short period of time.

Why Was the Decision Deferred to 2026?

MSCI aims to conduct a more comprehensive evaluation of how companies whose balance sheets are largely composed of crypto assets like Bitcoin should be classified within its indexes. Companies such as Strategy are at the center of this debate, as more than 50% of their balance sheets consist of Bitcoin.

Deferring the decision to the 2026 review indicates that MSCI does not want to approach the issue hastily and prefers to observe structural changes in the market more clearly.

What Does This Mean for the Bitcoin Ecosystem?

This development provides an important confidence boost for companies that use Bitcoin as a corporate treasury asset. At the same time, it demonstrates that the integration between traditional finance and crypto assets has reached a point that can no longer be ignored. MSCI’s approach is seen as a strong signal that the number of similar companies could increase in the coming years.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.