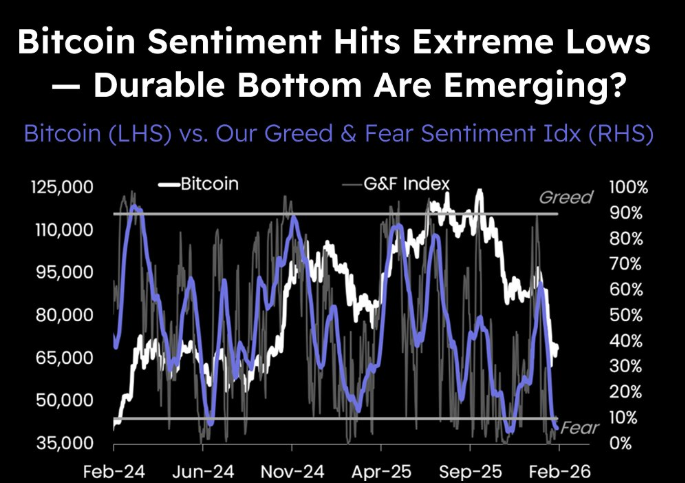

The mood across crypto markets has turned heavy — heavier than it’s been in a long while. In a fresh note, Matrixport said market sentiment has collapsed into deeply depressed territory, a zone that historically tends to precede major inflection points.

Short version: selling pressure may be running out of steam. Longer version? The path there is rarely clean.

Matrixport: Sellers may be exhausted, the floor is forming

According to Matrixport analysts, a key shift has appeared in the firm’s proprietary Bitcoin fear-and-greed metric. The 21-day moving average has dropped below zero and is now turning higher.

Technically, that transition often coincides with periods when selling becomes saturated and markets start searching for balance again.

Matrixport notes that sentiment has fallen to extreme pessimism. Historically, readings at these levels have marked attractive entry zones. Still, analysts caution that prices could drift lower in the near term before any durable recovery takes shape.

A small but important nuance: these “durable bottoms” rarely arrive in a single move. More often, markets bounce, retest, hesitate — then decide.

Sentiment hits four-year lows

Matrixport data shows comparable pessimism only around June 2024 and November 2025 — both following sharp drawdowns.

Independent measures tell the same story. The Fear & Greed Index from Alternative.me is hovering near 10 out of 100, firmly in “extreme fear” territory. The last time it reached similar depths was June 2022.

There’s another uncomfortable stat on the table: if Bitcoin closes February in the red, it will mark five consecutive monthly losses — the longest streak since 2018 and among the most sustained sell-offs in modern crypto history.

“Statistically oversold” territory

Mining sector voices are echoing the caution — and the opportunity.

On Monday, Frank Holmes said Bitcoin is trading roughly two standard deviations below its 20-day norm — a condition seen only three times over the past five years.

Historically, such extremes have favored short-term rebounds over the following 20 trading days, Holmes explained. Despite the current volatility, he remains constructive on the long-term outlook, pointing to resilient fundamentals.

At Hive Blockchain, the narrative is similar: price action looks fragile, but network security, infrastructure investment, and institutional engagement remain intact.

Reading between the lines

No single indicator tells the full story.

Sentiment is washed out. Technical metrics signal oversold conditions. At the same time, macro uncertainty persists and liquidity remains selective.

What’s emerging feels less like a clean bottom — and more like a market trying to breathe. Some traders are positioning for reflexive bounces. Others are waiting for confirmation. A large middle ground is simply watching, quietly.

Extreme fear has historically opened opportunity windows. But those windows rarely swing open smoothly. More likely, we’re entering a choppy transition phase.

Crypto doesn’t shout at moments like this. It whispers.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.