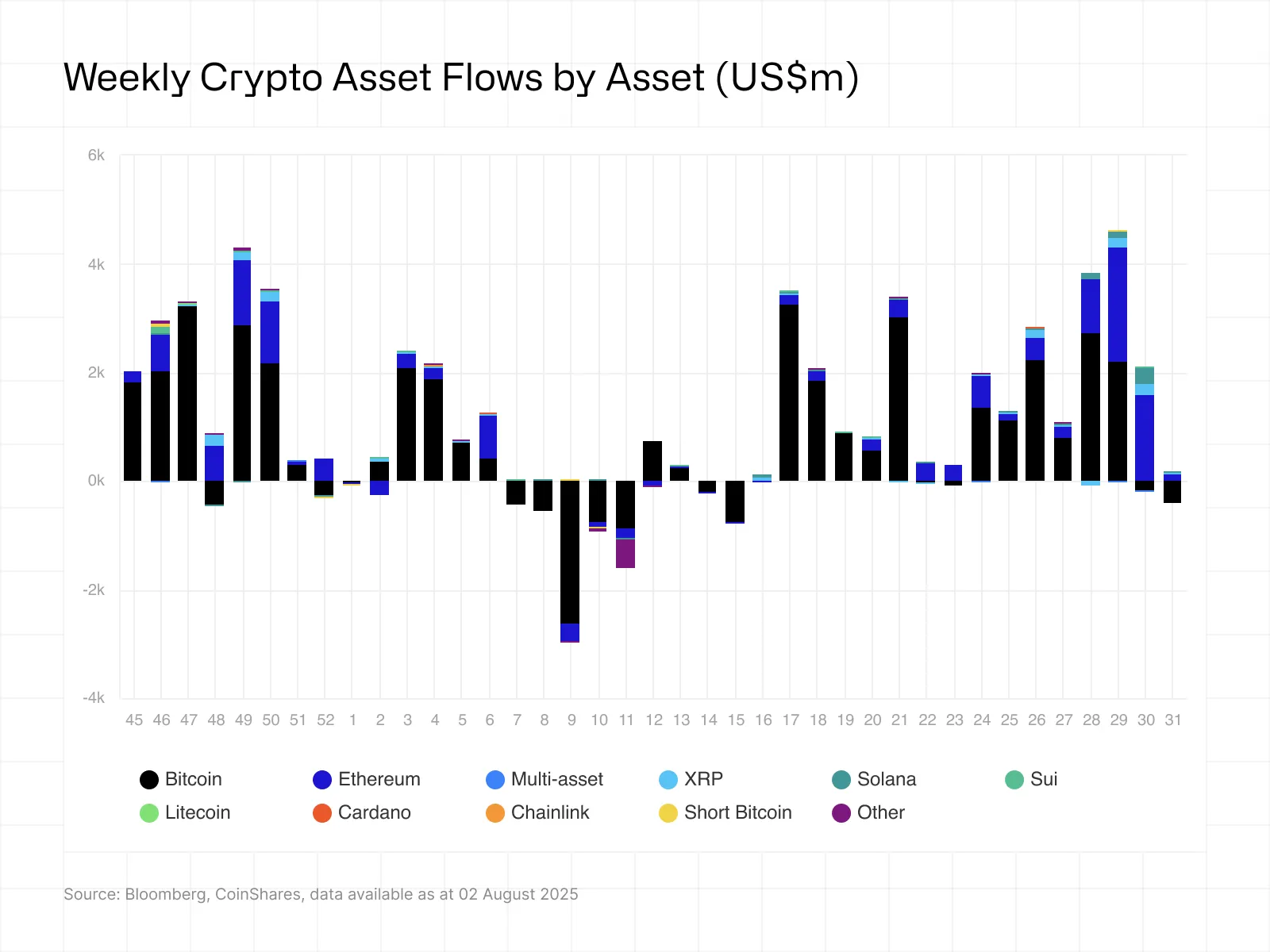

Last week, crypto investment products witnessed a significant shift as a 15-week streak of consecutive inflows came to an end. This reversal followed profit-taking from investors and hawkish comments made by the U.S. Federal Reserve after its interest rate decision. Global crypto exchange-traded products (ETPs) saw outflows totaling $223 million.

Crypto Funds Hit by Major Outflows

Crypto funds had started the week strong, attracting $883 million in inflows, but the trend reversed in the latter half of the week. This shift has been attributed to recent comments from the Federal Reserve and stronger-than-expected economic data from the U.S.

Despite the weekly setback, the past 30 days have seen $12.2 billion in inflows to crypto investment products, accounting for around 50% of year-to-date inflows. As a result, these outflows are largely being seen as modest profit-taking rather than a significant market correction.

Fed Chair Jerome Powell’s statements also had a clear impact on investor sentiment, particularly around interest rate expectations. The probability of a rate cut in September dropped from 63% to 40%.

Bitcoin Starts August Weak

This drop in investor confidence coincided with the start of August, historically one of the weakest months for Bitcoin. According to CoinGlass data, Bitcoin’s median return in August is -7.49%.

The majority of last week’s outflows came from Bitcoin-focused products, with $404 million exiting those funds. Some analysts suggest a potential new catalyst for Bitcoin may emerge after the summer break. According to one analysis, renewed attention toward Bitcoin could surface after the U.S. Congress reconvenes in early September.

Historically, periods of fiscal uncertainty have provided significant momentum for assets like Bitcoin that have fixed supply.

Ethereum Defies the Trend

While global crypto funds saw general outflows, Ethereum-focused investment products continued to stand out. Ethereum funds recorded their 15th consecutive week of net positive inflows, attracting $133 million.

This consistent interest highlights ongoing investor confidence in Ethereum and its long-term potential.

Positive Moves for XRP, Solana, and Sui

Weekly data shows that XRP, Solana, and Sui also saw positive inflows. XRP products gained $31.2 million, Solana attracted $8.8 million, and Sui saw $5.8 million in new investments.

President Trump Signs New Tariff Order

Effective from August 7, U.S. President Donald Trump signed an executive order imposing reciprocal import tariffs ranging between 15% and 41% on products from 68 countries.

While this move caused turbulence in global markets, it did not trigger a major sell-off in the crypto markets. Instead, it led to what some experts describe as a “rebalancing.” According to analysts, the fact that the total market capitalization remained above $3.7 trillion reflects continued confidence fueled by structural flows, institutional interest, and regulatory clarity.

Under these conditions, experts suggest that altcoin market stability could gradually return.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.