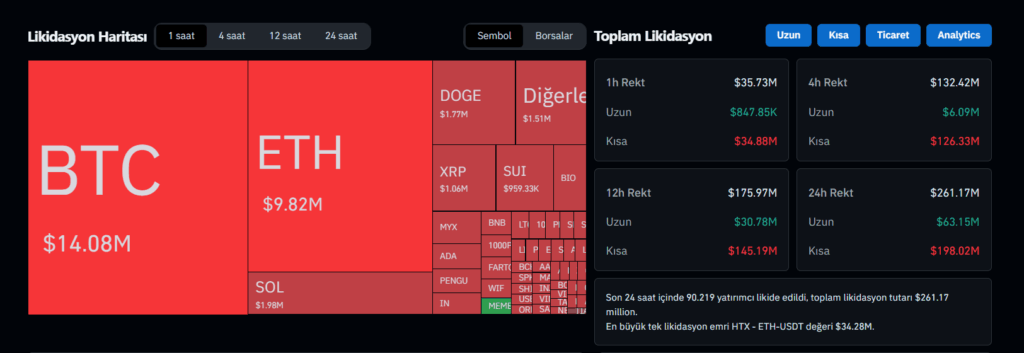

In the past 24 hours, a major liquidation event totaling $260 million has shaken the crypto market, causing significant volatility. Investors are eager to understand the reasons behind this liquidation and its consequences.

Details and Impact of the Liquidation

According to data, $200 million of the total liquidation came from short positions. This indicates a bullish move contrary to the prevailing bearish expectations. A large portion of investors believed prices would drop, but unexpected price surges triggered the closure of short positions.

Bitcoin’s rise to $116,466 and Ethereum reaching $3,810 accelerated this liquidation process. The largest single liquidation occurred in the HMX-ETH-USDT pair, resulting in a loss of $34.28 million in one transaction.

Key Takeaways for Crypto Investors

This event serves as a warning for crypto investors, highlighting the high volatility of the market once again. Excessive leverage usage is the primary cause of such large liquidations. Therefore, risk management is more crucial than ever.

Long-term strategies are considered safer compared to short-term speculation, especially in leveraged trading. Following overall crypto market trends instead of reacting to instant price moves is a more rational approach. Carefully monitoring market developments is essential for making informed decisions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.