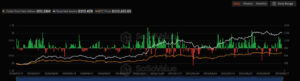

On September seventeenth, two thousand twenty-five, U.S. spot Bitcoin ETFs recorded a total net outflow of 51.28 million dollars — the first after seven consecutive days of net inflows.

U.S. spot Bitcoin ETFs had recently drawn attention with strong inflows in the past weeks. However, on September seventeenth, they recorded net outflows — a development signaling that short-term investors may have taken profits or shifted toward risk aversion.

According to analysts, volatility in Bitcoin’s price and global macroeconomic uncertainty may have influenced investors to reduce their ETF positions.

Outflows Also Seen in Ethereum ETFs

Alongside Bitcoin ETFs, spot Ethereum ETFs also registered total net outflows of 1.89 million dollars on the same day. This indicates that investors on the Ethereum side are also acting cautiously.

In particular, Fidelity’s FETH product recorded outflows of 29.19 million dollars, making it the Ethereum ETF with the largest fund loss of the day. This data suggests that major institutional players have been closing out short-term positions.

The outflows in Ethereum ETFs are mainly linked to recent market volatility, regulatory uncertainty, and macroeconomic risks. Analysts note that institutional investors are likely closing short-term positions as part of their risk management strategies, which has been a key driver of these outflows.

The Importance of Institutional Interest

In recent months, rising institutional interest in both Bitcoin and Ethereum ETFs had accelerated the integration of crypto markets into traditional finance. However, these latest outflows show that investors are acting more cautiously in the short term, adjusting their positions based on market conditions. Analysts emphasize that such outflows do not disrupt the long-term trend but could increase short-term volatility.

Assessment

The net outflows seen in U.S. spot Bitcoin and Ethereum ETFs signal that profit-taking has begun in the crypto market. With 51.28 million dollars withdrawn from Bitcoin ETFs and 1.89 million dollars from Ethereum ETFs, investors are showing a cautious stance.

Nevertheless, the continued existence of ETF products and their high trading volumes confirm that crypto assets are becoming a permanent investment vehicle for institutional investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.