The crypto market is on fire again! Over the weekend, the total market capitalization reached a new all-time high. Although it slightly retraced on Monday, investors are still witnessing a strong upward trend. So, why is crypto rising today? Here are the five main factors fueling this rally.

Bitcoin Hits an All-Time High

Bitcoin continues to follow its historical October uptrend. Recently, BTC surged to a record high, gaining over ten percent in just seven days. Currently trading around its peak level, Bitcoin holds a massive market cap and a high 24-hour volume.

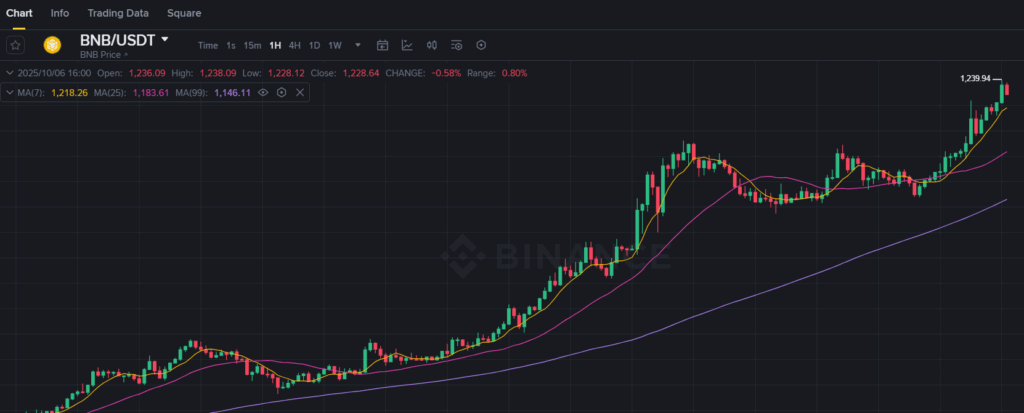

Meanwhile, Binance Coin (BNB) also reached new highs, further strengthening the market momentum. Seasonal gains combined with fresh capital inflows created a classic breakout scenario.

Fed Signals Possible Rate Cuts

US Federal Reserve dynamics also play a key role. Fed Chair Stephen Miran stated that current monetary policy is “too tight” and publicly advocated for a rate cut. This dovish signal boosted investor confidence and supported risk assets like Bitcoin.

Markets have already priced in this possibility, strengthening the bullish momentum in crypto.

Massive Spot Bitcoin and Ethereum ETF Inflows

Institutional demand remains strong. Spot Bitcoin ETFs saw substantial inflows recently, pushing the total ETF holdings to new levels.

Ethereum ETFs also recorded strong inflows. These figures demonstrate how Wall Street is infusing crypto with substantial capital, signaling a structural shift and long-term bullish potential.

Liquidation Wave Supports Healthy Market Structure

In the past 24 hours, thousands of traders were liquidated, totaling millions in positions. Such liquidation waves remove over-leveraged positions and help stabilize the market.

For instance, Hyperliquid’s largest single BTC-USD order was significant, clearing many long positions while new long positions emerged, setting the stage for sustainable upward momentum.

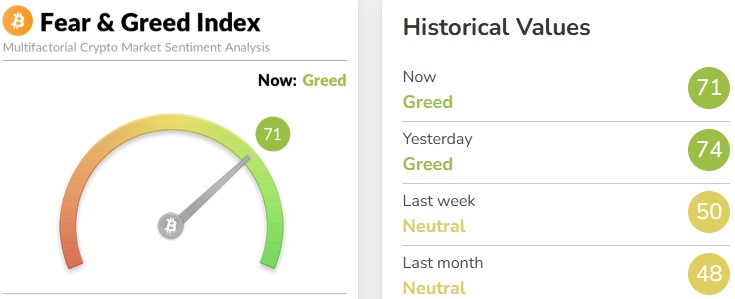

Fear & Greed Index Shows Investor Optimism

The Fear & Greed Index currently signals strong greed. Historically, this level often precedes Bitcoin rallies and altcoin rotations. Although extreme greed can trigger short-term corrections, it also reflects strong investor confidence fueling upward momentum.

Investor Takeaways: Stay Strategic

The current rally is driven by Fed policy, ETF inflows, and strong investor sentiment. However, volatility remains high. Traders should stay alert, avoid excessive leverage, and monitor key support levels.

If Fed rate cuts accelerate and ETF inflows continue, the market could enter a longer bull cycle.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.