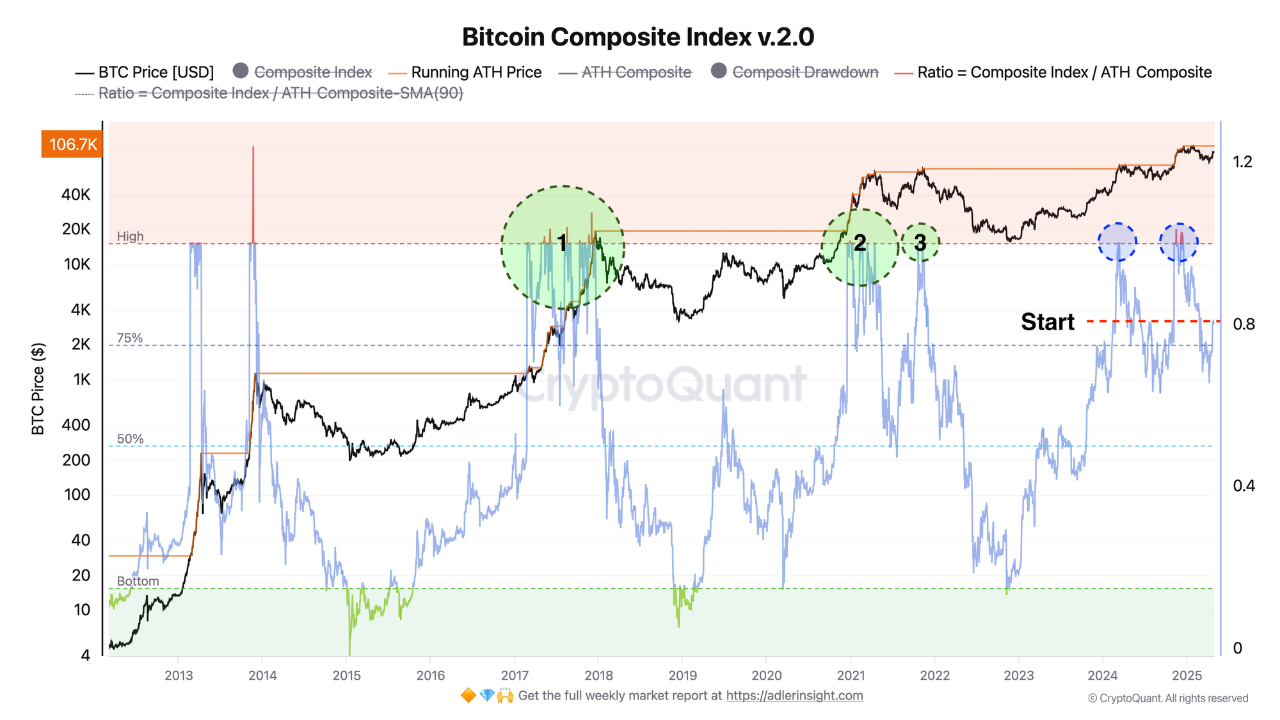

CryptoQuant analyst Axel Adler Jr. has evaluated three possible Bitcoin price scenarios for the next six months. His analysis indicates that the current on-chain momentum is in the “initial rally” zone. According to Adler, there are three key possibilities that could shape the market from this point forward.

Bitcoin Is Warming Up for a New Rally: 3 Scenarios by Axel Adler

In his May 1 analysis, Adler examined three potential trends for Bitcoin over the next six months. He emphasized that the on-chain momentum is currently flashing “start” signals. The detailed analysis, published on CryptoQuant.com, breaks down the scenarios as follows:

Optimistic Scenario (Bullish)

If the Ratio breaks through 1.0 and holds above it, key on-chain indicators like NUPL and MVRV could reflect a new upward impulse. In this case, Bitcoin price could reach the $150K–$175K range, mirroring the cycle logic of 2017 and 2021.

Base Case Scenario (Consolidation)

If the Ratio stays within the 0.8–1.0 range, the market may continue in a sideways trend within a wide price corridor. In this scenario, the price is expected to range between $90K–$110K, with participants maintaining their positions but avoiding increased exposure.

Pessimistic Scenario (Correction)

If the Ratio drops to 0.75+, short-term holders might begin taking profits, potentially triggering a price correction to the $70K–$85K range. However, Adler notes that a correction has already occurred, making this scenario less likely.

BTC Rally and Its Impact on the Altcoin Market

In 2025, Bitcoin dominance (BTC.D) hit 64%, reaching its highest levels of the year and significantly delaying altcoin recovery.

Between January and April 2025, Bitcoin dominance increased by 13%. During this period, the altcoin market cap (excluding BTC and ETH) dropped from $1.13 trillion to $817 billion, resulting in a $300 billion (~28%) decline.

Notably, altcoins outside the top 10 cryptocurrencies showed signs of recovery around the $200 billion support zone from 2024.

If the market repeats previous cycles, a breakout above the 50-week moving average (50WMA) could push altcoins toward the $500 billion resistance zone.

Additionally, in the past three months, a few altcoins outperformed BTC, including Fartcoin (+8%), PancakeSwap (CAKE, +2.8%), and Monero (XMR, +19%). During the same period, Bitcoin dropped by 10%.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.