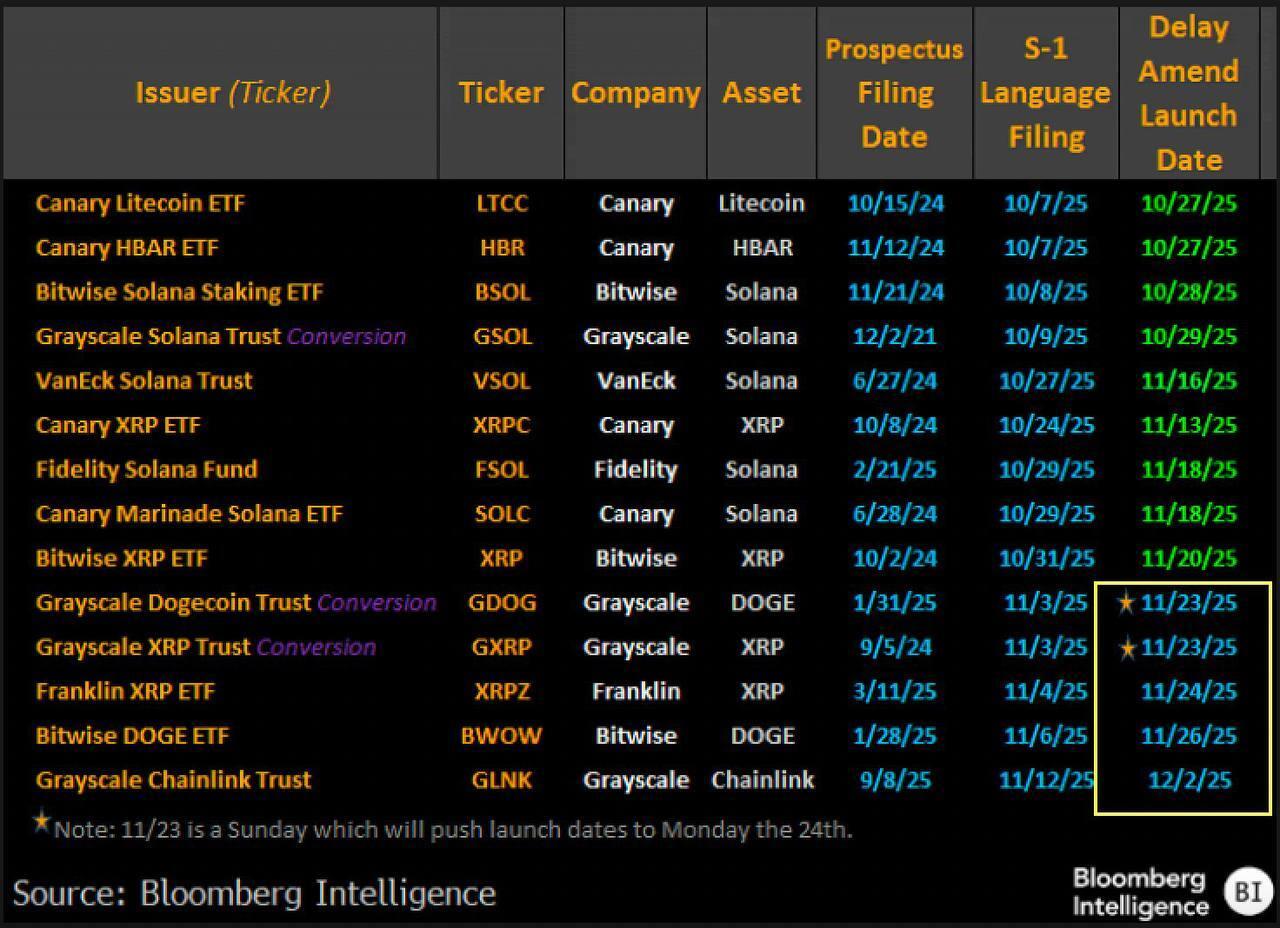

The crypto market is entering a new phase of regulatory-driven expansion, particularly on the exchange-traded fund (ETF) front. Bloomberg senior ETF analyst Eric Balchunas recently highlighted an accelerating wave of spot altcoin ETFs poised to hit the market. According to his assessment, five new spot products are scheduled to begin trading within the next six days—signaling what could be the beginning of a much broader roll-out.

Growing Momentum: “Over 100 New ETFs Could Arrive in Six Months”

Balchunas emphasized that investor appetite for spot altcoin ETFs has strengthened significantly. While the immediate calendar includes five confirmed listings, he noted that this movement represents only an initial step. Market expectations point to more than 100 additional spot crypto ETFs potentially launching over the next half-year.

This projection aligns with the broader trend that followed the approval of spot Bitcoin and Ethereum ETFs in the United States, which opened the door for increased competition and interest within the altcoin segment.

The Five Altcoin Spot ETFs Set to Launch Soon

According to Balchunas, the spot ETFs preparing to go live in the coming days include:

-

Grayscale Dogecoin Trust (GDOG)

-

Grayscale XRP Trust (GXRP)

-

Franklin XRP ETF (XRPZ)

-

Bitwise DOGE ETF (BWOW)

-

Grayscale Chainlink Trust (GLNK)

Each of these investment products is designed to expand institutional access to their respective assets, while introducing new channels of liquidity. The inclusion of high-volume cryptocurrencies such as DOGE, XRP, and LINK underscores the increasing willingness of traditional financial institutions to engage with well-established altcoin markets.

Potential Market Impact of the Altcoin ETF Wave

The arrival of multiple spot altcoin ETFs may introduce short-term volatility, particularly in the underlying assets. Increased institutional participation—especially from large entities seeking regulated exposure—could influence liquidity flows and price dynamics in the near term.

Many analysts view the expansion of altcoin ETFs as a potential foundation for the next stage of crypto market growth. However, they also note that the pace of this evolution will depend on regulatory timelines and overall investor sentiment.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’ t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.