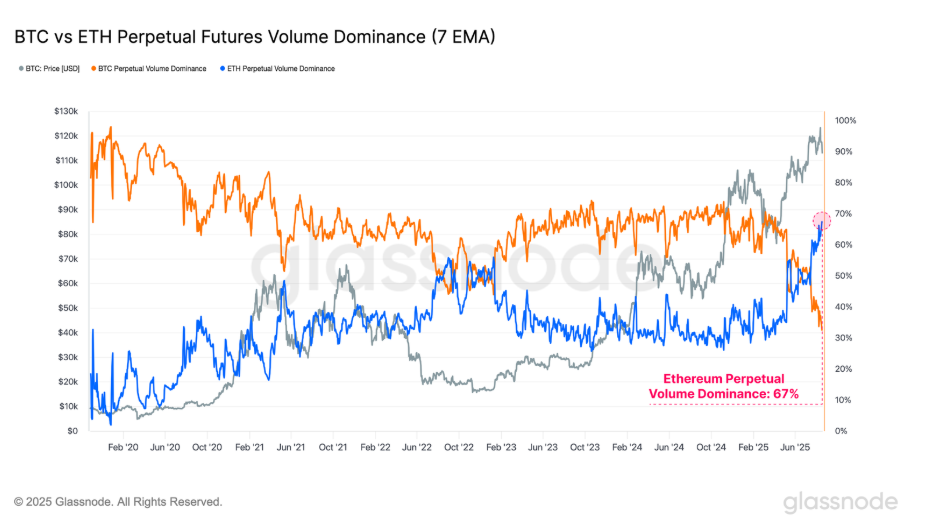

Ethereum (ETH) open interest in futures surged to 67%, according to Glassnode data, marking a historic peak. This figure highlights a sharp increase in investor risk appetite in recent weeks. Moreover, favorable macroeconomic conditions could further expand the upcoming altcoin season. ETH’s perpetual futures volume also reached 67%, meaning two-thirds of all crypto perpetual contracts were executed in Ethereum.

Glassnode reports show that investors continue to favor high-risk positions despite rising inflation concerns in the U.S. While BTC-ETH open interest is converging, leveraged traders are showing strong preference for ETH. Bitcoin’s spot dominance stands at 59.42%, while Ethereum is at 13.62%. However, in open interest, the gap narrows: Bitcoin holds 56.7%, ETH 43.3%. This indicates Ethereum’s growing prominence among risk-seeking investors.

ETH’s Market Position and Trading Volume

The surge in Ethereum’s futures volume reflects strong investor interest in the altcoin sector. Additionally, ETH’s share of perpetual futures hit a record high, proving investors are willing to take more risks. This trend could translate into short-term price performance for Ethereum.

Glassnode notes that although Bitcoin recently reached all-time highs, Ethereum largely guided market direction. As a result, ETH’s open interest dominance increased, and investors maintained a bullish outlook. Furthermore, Fed decisions on interest rates directly influence ETH’s potential to outperform BTC. If Jerome Powell signals a move toward rate cuts at the Jackson Hole meeting, Ethereum is expected to rise faster.

In conclusion, ETH’s record open interest in futures demonstrates growing investor attention and hints at a potential altcoin season. Moreover, current market trends position Ethereum as a key focus for crypto traders in the near term.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.