ETFs in the cryptocurrency market continue to attract investor interest and support market activity. According to data released on January 15, Ethereum and Bitcoin spot ETFs recorded net inflows for the fourth consecutive day. This not only shows that institutional interest remains strong, but also indicates continued confidence in crypto assets. As investors diversify their portfolios through ETFs, market liquidity and trading volume are also strengthened. This trend points to a steady continuation of long-term investor interest in the crypto market.

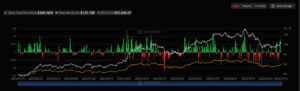

Million-Dollar Inflows into Ethereum Spot ETFs

On January 15, Ethereum ETFs recorded a total net inflow of $164.37 million. This four-day streak of inflows highlights strong investor interest in Ethereum and an improving market sentiment. ETF officials note that this trend could further boost institutional confidence in the market and attract more investors.

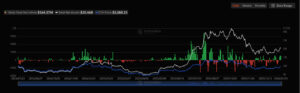

Bitcoin Spot ETFs Maintain Their Strength

Bitcoin ETFs recorded a net inflow of $100.18 million on the previous day. This fourth consecutive day of inflows shows that institutional investor interest in Bitcoin ETFs remains intact. Investors are using this trend to monitor market confidence and find opportunities to diversify their portfolios. The stable performance of Bitcoin ETFs is seen as a positive signal for long-term investors in the crypto market.

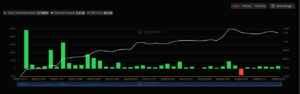

Stable Flows into Solana Spot ETFs

Solana ETFs recorded a net inflow of $8.94 million on January 15. This inflow demonstrates sustained investor interest in Solana and highlights the importance of altcoin ETFs for portfolio diversification. Although smaller in volume, Solana ETFs continue to attract attention with their steady inflows. Through Solana ETFs, investors can diversify their portfolios while also gaining exposure to opportunities in the altcoin market. These consistent inflows indicate ongoing investor confidence in altcoins and position Solana as an attractive option for long-term investors.

Million-Dollar Inflows into XRP Spot ETFs

XRP ETFs stood out during the same period with a net inflow of $17.06 million. This increase shows continued demand for XRP ETFs and growing market interest. XRP ETFs offer meaningful opportunities for investors looking to diversify their altcoin portfolios, enabling risk distribution across different crypto assets. This upward trend also suggests that XRP is emerging as a stable option within the ETF market and a reliable alternative for long-term investors.

Overall Assessment

The consecutive net inflows into crypto ETFs clearly demonstrate sustained investor confidence and ongoing institutional interest. The fact that Ethereum and Bitcoin ETFs have recorded net inflows for four straight days indicates steady growth in the crypto market and continued long-term trust from institutional investors. Meanwhile, altcoin ETFs continue to provide diversification opportunities and additional investment options. Overall, this trend signals that both institutional and retail investor interest in crypto ETFs remains strong.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.