Crypto mining and technology company BitMine Immersion Technologies has recently made headlines with a strategic move in the Ethereum (ETH) market. The company purchased approximately $70 million worth of ETH, strengthening its portfolio and further solidifying its presence in the crypto sector.

Purchase Details: Four-Stage Transaction

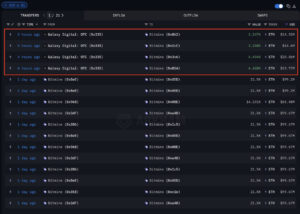

BitMine’s latest acquisition wasn’t executed in a single transaction but carried out in several parts through Galaxy Digital’s OTC (over-the-counter) desk. The transactions were disclosed as follows:

- 3,247 ETH → approx. $14.50 million

- 3,258 ETH → approx. $14.60 million

- 4,494 ETH → approx. $20 million

- 4,428 ETH → approx. $19.75 million

In total, these purchases of 15,427 ETH amount to approximately $69 million at the reported prices. According to experts, such OTC transactions make it possible to carry out large acquisitions without directly impacting the spot market.

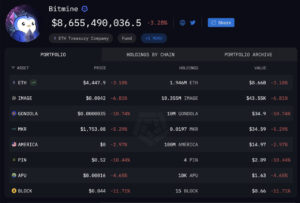

BitMine’s Ethereum Holdings

Reports indicate that BitMine currently holds 1.95 million ETH, valued at about $8.66 billion at current prices. With this scale, the company stands out as one of the largest institutional holders of Ethereum.

Although this figure may seem like a small share compared to the total ETH supply, BitMine’s impact becomes more pronounced when staked or locked supplies are taken into account.

BitMine’s move is seen not only as an investment but also as a strong indicator of confidence in Ethereum’s long-term potential. The company’s ETH accumulation strategy shows that institutional investors now view crypto assets not merely as short-term speculative tools, but as long-term strategic reserves.

Market Mechanics: Why OTC?

The main reason large companies execute transactions via OTC is to prevent slippage and keep price fluctuations to a minimum:

- Avoid sudden spikes in the spot market,

- Manage large orders outside the order book,

- Conduct trades more discreetly and in a controlled manner.

Indeed, no notable surge in ETH price was observed during BitMine’s acquisitions. On-chain analytics platforms like Arkham confirmed that the size and timing of the transfers were consistent with OTC transactions.

Risks and Strategic Move

Holding large amounts of ETH carries significant risks due to volatility. Sudden price drops could negatively impact BitMine’s balance sheet. However, the company’s decision to make such large acquisitions is interpreted as a clear demonstration of its confidence in Ethereum’s long-term value.

Institutional treasuries are increasingly incorporating crypto into their portfolios. BitMine’s latest move is seen as one of the strongest signals of this trend. According to experts, these OTC acquisitions confirm that institutional players’ interest in the crypto market continues to grow. BitMine’s step may also serve as a signal flare for other major industry players.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.