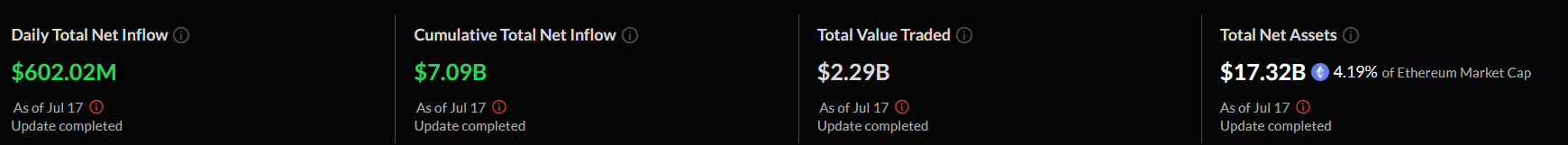

A historic milestone occurred in the 18-month history of U.S. spot crypto ETFs. Ethereum ETFs have, for the first time, surpassed Bitcoin ETFs in daily net inflows. According to on-chain analytics platform SoSoValue, nine spot Ether ETFs recorded $602 million in net inflows on Thursday. In comparison, the eleven Bitcoin ETFs took in $522.6 million.

This shift came right after Ethereum funds broke their own record the day before with a staggering $726 million in a single day. As a result, the total ETH held by these funds neared 5 million, pushing Ether’s price above $3,400—its highest since January.

BlackRock’s ETHA Drives Ethereum ETF Momentum

The primary driver behind the surge was BlackRock’s iShares Ethereum Trust (ETHA), which attracted around $550 million in inflows on Thursday. This marked the fund’s second consecutive daily record, outperforming BlackRock’s flagship Bitcoin ETF (IBIT) for the day.

According to Arkham Intelligence and Farside Investors, ETHA has seen $1.25 billion in inflows over the past five sessions and now manages nearly $7 billion in Ethereum assets—roughly 20% of the total assets across all U.S. Ethereum ETFs.

Bloomberg Intelligence analyst James Seyffart emphasized the momentum, noting that U.S. spot Ether ETFs have accumulated over $5.5 billion since launch, with $3.3 billion of that arriving since mid-April. He cited the re-emergence of a double-digit cash-and-carry yield on CME Ether futures as a contributing factor.

Staking Support, SEC Optimism Fuel Ethereum Inflows

Nasdaq recently filed to enable staking within ETHA, which would allow the fund to generate network rewards. If approved, this could increase its yield above 5%, positioning Ethereum ETFs as rare instruments offering both growth and income potential.

Bitcoin ETFs still lead in overall scale. Since January 2024, they have attracted $53 billion in net inflows and now manage over $150 billion in assets. Nate Geraci, President of ETF Store, highlighted that Bitcoin funds recorded inflows in 26 of the last 27 sessions, adding over $10 billion in institutional capital.

However, Ethereum is gaining ground. Investors now factor in more than just staking yields. Expectations that the SEC will approve staking-enabled ETFs by year-end, along with bipartisan support for the GENIUS and CLARITY bills—which would classify major crypto assets as commodities—have further boosted confidence.

Whether this shift marks a new trend or a short-term anomaly remains to be seen. For now, the market headlines speak for themselves:

Ethereum ETFs beat Bitcoin ETFs.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.