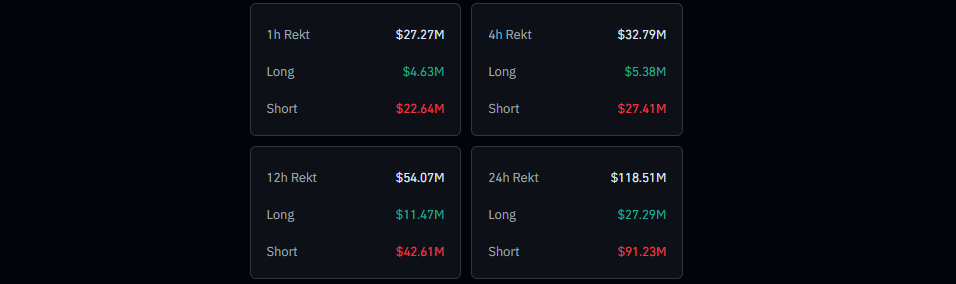

In the past 24 hours, approximately $91 million worth of open Ethereum short positions have been liquidated, sparking a significant rally in ETH’s price.

Institutional Buying and Positive Market Drivers

This recent price surge is largely fueled by increased buying from institutional investors. Treasury strategies that adopt Ethereum (ETH) as a reserve asset are boosting confidence in the network, contributing positively to price momentum.

Moreover, recent announcements from U.S. pension funds and expectations of interest rate cuts in September have strengthened investor sentiment, further supporting ETH’s upward trajectory.

Impact of Short Position Liquidations on Market Dynamics

The large-scale liquidation of short positions has eased selling pressure on ETH, creating stronger buying momentum in the market. This shift could pave the way for further price appreciation in the short term.

ETH’s strong recent performance is not only significant for Ethereum itself but also helps to fuel optimism across the broader altcoin market.

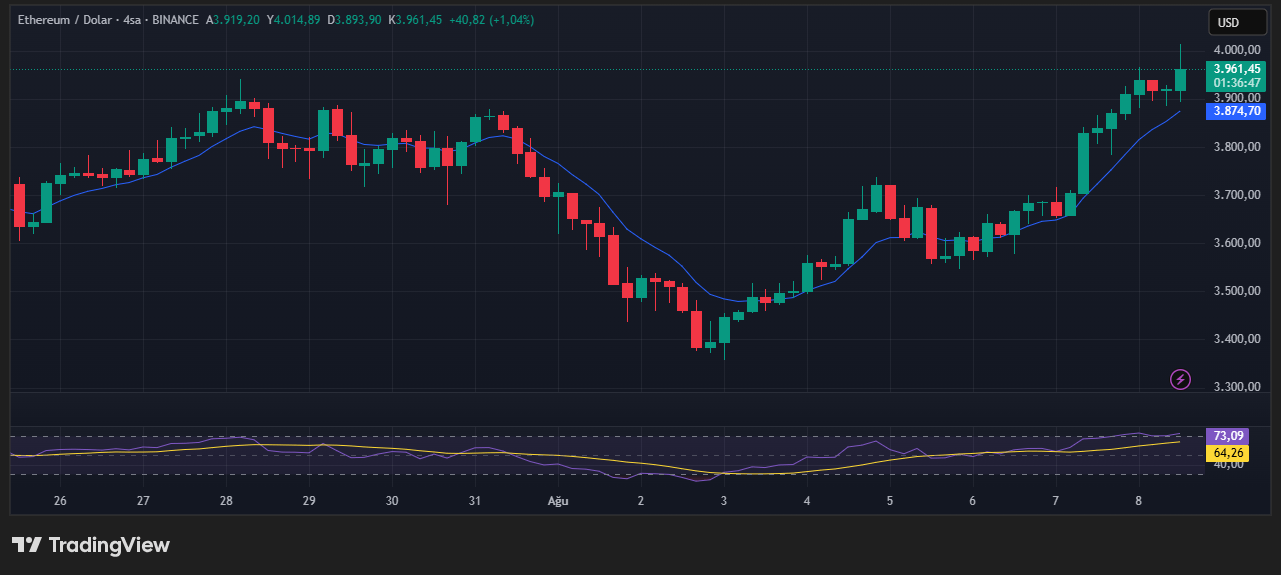

Ethereum (ETH) Price Overview

A strong surge in Ethereum’s price triggered a wave of liquidations, sending ETH up 3.30% to $4,000. This was the highest level in the last eight months. At the time of writing, the ETH price was around $3,961.

This content does not constitute investment advice. Markets carry high risks, and it is important to conduct your own research before making any investment decisions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.