Ethereum (ETH) launched a strong rally after Federal Reserve Chair Jerome Powell hinted at potential interest rate cuts during his Jackson Hole speech, surpassing $4,869 and surpassing its November 2021 record. ETH briefly reached $4,887 and was trading at $4,734 as the news was being prepared.

Powell’s Message Ignites the Markets

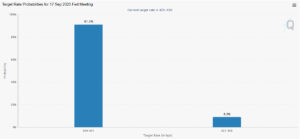

Speaking at the Jackson Hole symposium, Powell stated that the Fed has “shifted the balance of risks” and that current economic conditions could support a policy change. This change in tone was interpreted by the markets as an increased likelihood of an interest rate cut in September.

According to CME FedWatch data, the probability of a rate cut rose from 70% at the beginning of the week to 91%.

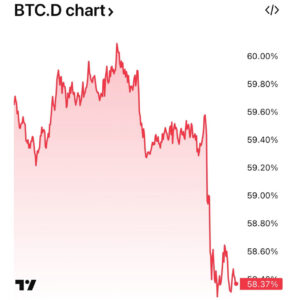

Strong Increase in the Ethereum-Bitcoin Ratio

With Ethereum’s surge, the ETH-BTC ratio climbed above 0.041, reaching the highest level of the year. This caused Bitcoin’s market dominance to fall to 58.5%, highlighting Ethereum’s relative strength along with that of other altcoins.

A Turning Point for Investors

Ethereum’s historic breakout signals the end of an approximately four-year wait. It has also fueled speculation that a new altcoin cycle may be beginning in the markets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.