Ethereum, the world’s second-largest blockchain network, celebrates its 10th anniversary on July 30, 2025. This milestone coincides with the growing interest of institutional firms and Wall Street in adopting Ethereum as a treasury asset. Ether is now seen not just as a technology, but also as a strategic digital reserve.

Corporations Are Accumulating ETH

Thanks to Ethereum’s 10 years of uninterrupted uptime and its smart contract infrastructure, it has laid the foundation for revolutionary developments like decentralized finance (DeFi) and tokenization. This has significantly increased large companies’ interest in Ether.

According to data, the five corporate entities holding the most Ether are as follows:

1. BitMine Immersion Technologies – 625,000 ETH

A publicly traded Bitcoin mining company, BitMine currently holds the most Ether. This amount accounts for 0.52% of ETH’s circulating supply. The company had previously announced plans to acquire up to 5% of ETH’s supply. Recently, it also revealed a $1 billion stock buyback program.

2. Sharplink – 438,190 ETH

Listed on Nasdaq, Sharplink defines ETH as its “primary treasury asset.” Between July 21 and last Sunday, the company acquired $290 million worth of ETH at an average price of $3,756.

3. Bit Digital – 100,603 ETH

Bit Digital, which shifted from Bitcoin to Ethereum, announced on July 7 that it had raised $172 million through a new stock issuance and converted its balance sheet to Ether.

4. BTCS Inc. – 70,028 ETH

An Ethereum node validator, BTCS recently sold $10 million in convertible notes. In 2025 alone, it has raised a total of $207 million in capital.

5. GameSquare Holdings – 12,913 ETH

Media and tech firm GameSquare stated it holds this amount as part of a broader $250 million crypto treasury strategy.

Wall Street’s Growing Interest in Ethereum

According to Bitget CEO Gracy Chen, institutional investors now view Ethereum, much like Bitcoin, as the next-generation reserve asset. Especially with the increasing vision of asset tokenization on the blockchain, Ethereum appears to have a strong market advantage.

As Chen explains:

“Ethereum is expected to capture a large share of the asset tokenization market. That’s why Ethereum is becoming the next strategic treasury asset for institutional investors.”

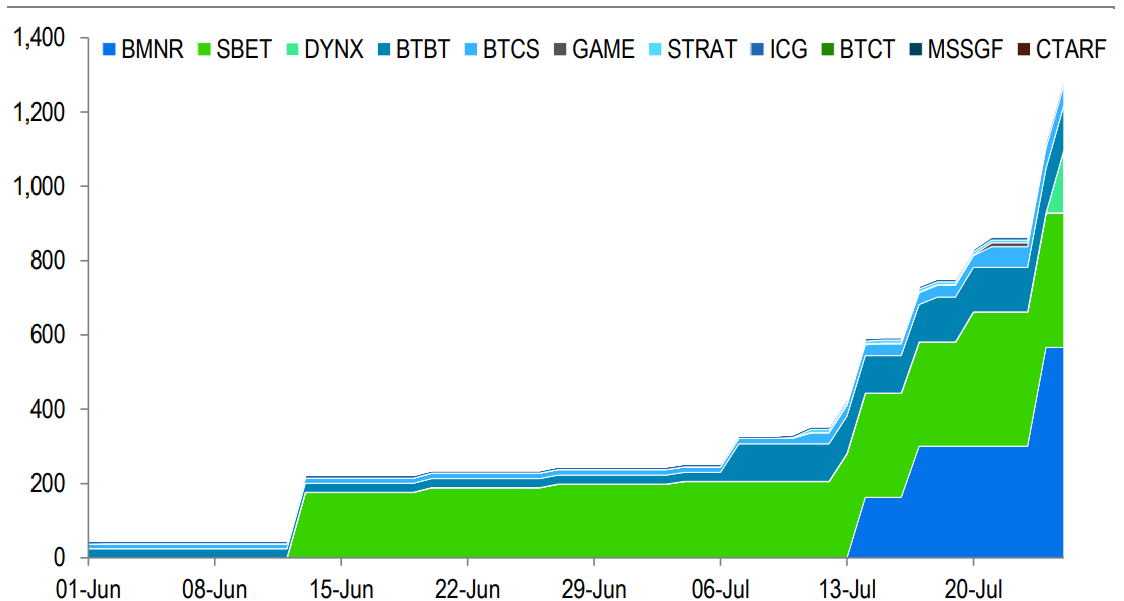

A new report by Standard Chartered also supports this view. The report states that since June, crypto treasury firms have acquired more than 1% of Ethereum’s circulating supply. In the same period, Bitcoin-focused firms have lagged behind.

In the long term, it is suggested that Ethereum-focused companies could hold up to 10% of the total ETH supply. This trend is fueled by opportunities such as staking and programmable returns through DeFi.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.