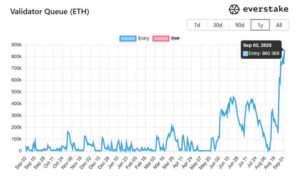

The Ethereum validator entry queue has reached its highest level in the past two years as of early September 2025, with over 860,000 ETH (~$3.7 billion) waiting to be staked. This highlights strong confidence in Ethereum’s long-term potential, a tightening supply, and the maturation of its staking economy.

Ethereum Staking Queue Hits Record Levels

The surge in Ethereum’s validator queue demonstrates strong demand from both individual and institutional investors to participate in staking pools.

- Pending ETH: 860,000 ETH

- Value: approximately $3.7 billion

- Share of total staked ETH: 31%

This trend highlights Ethereum’s growing appeal as a yield-generating asset and the strengthening of institutional participation.

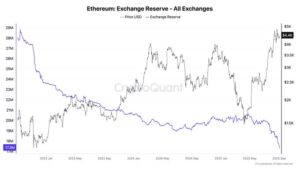

Liquidity and Market Implications

Directing large amounts of ETH into staking reduces the liquid ETH available on exchanges. This can create a potential supply squeeze, directly impacting market prices and investment strategies.

Historical data shows that previous spikes in the validator queue have often triggered Ethereum price rallies. For example, similar dynamics were observed during the Shanghai upgrade in 2023. At that time, however, retail investors played a balancing role, which limited price swings.

Analyst and Protocol Insights

On-chain data confirms that staking volumes have been steadily increasing in recent weeks, reflecting stronger investor commitment. Everstake, a staking protocol, commented on this trend:

“More people are trusting Ethereum’s long-term value and want to participate in securing it.”

The record level in Ethereum’s validator queue indicates that both institutional and individual investors are increasingly staking ETH to support network security and earn long-term returns.