The crypto market recorded a $28.5 billion increase in the last 24 hours, bringing the total market capitalization to $3.31 trillion. Several key developments played a role in this rise. First, the Trump family’s DeFi project, World Liberty Financial (WLF), is making its WLFI token transferable in response to investor demand. This move is boosting liquidity and investor interest.

The ruble-backed stablecoin A7A5, based in Kyrgyzstan, achieved a transaction volume of $9.3 billion in just four months. However, despite having a market cap of $156 million, the high volume was found to be largely generated by a few accounts repeatedly circulating tokens. This has drawn attention to the activity in the stablecoin market.

Invesco and Galaxy have jointly filed with the SEC for the “Invesco Galaxy Solana ETF.” This initiative is increasing institutional interest in Solana and the broader crypto market. Analysts suggest that the ETF’s approval could boost liquidity for Solana and DeFi projects, positively impacting the market.

Strong Moves in Bitcoin and DeFi

The U.S. Dollar Index (DXY) fell to its lowest level since 2022. Amid rising geopolitical risks, Bitcoin has emerged as a safe haven. Analysts highlight a capital shift from traditional finance to crypto assets. Additionally, Metaplanet increased its Bitcoin holdings by 1,234 BTC, bringing the total to 12,345 BTC. This move surpasses Tesla’s Bitcoin position, strengthening the company’s crypto presence. Metaplanet is targeting a 315% return by 2025.

Cryptocurrencies are now being accepted as reserve assets for home loans. A statement by the U.S. Federal Housing Agency noted that Bitcoin and other cryptos held on regulated exchanges can now be used as assets in mortgage applications. This regulation allows investors to secure loans without liquidating their crypto, accelerating mainstream adoption.

Market Sentiment and Altcoin Season

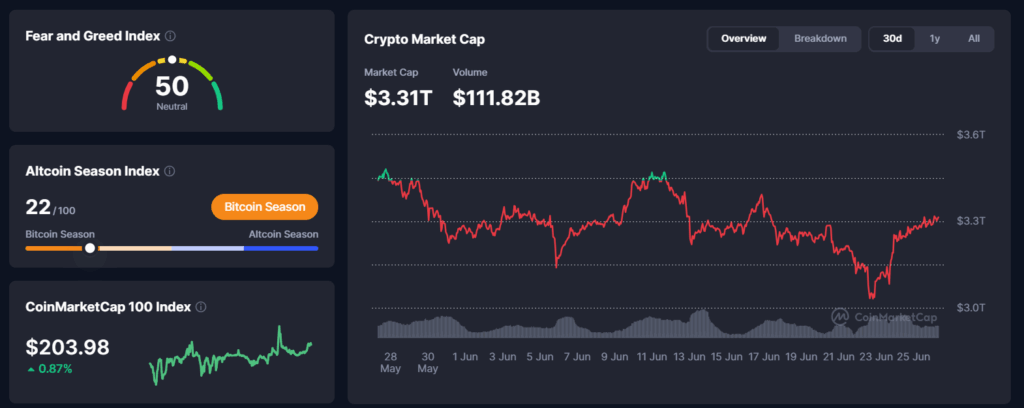

According to CoinMarketCap, the Bitcoin Fear and Greed Index stands at 50, indicating a neutral sentiment. Investors are neither overly fearful nor greedy, showing cautious optimism and market stability.

Bitcoin’s market dominance is at 64.8%, suggesting growing interest in altcoins and portfolio diversification. Analysts believe the altcoin season has begun and expect the trend to continue.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.