Measures of global economic and geopolitical uncertainty have climbed to record levels, surpassing the peaks observed after the September 11 attacks, the 2008 global financial crisis, the European sovereign debt crisis, and even the Covid-19 pandemic. This milestone is not merely symbolic; it has meaningful implications for financial markets, global trade flows, investment planning, and monetary policy expectations.

The surge in uncertainty indicators reflects a convergence of pressures: escalating geopolitical tensions, persistent trade frictions, elevated public debt burdens, inflationary risks, and ambiguity surrounding central bank policy direction. Unlike past episodes driven by a single dominant shock, today’s environment is shaped by multiple overlapping risk factors.

9/11: A Sudden Security Shock

The September 11, 2001 attacks triggered a profound confidence shock across global markets. U.S. equity exchanges remained closed for several days, and when trading resumed, risk assets experienced sharp declines. Industries such as aviation, tourism, and insurance faced immediate and severe losses. The episode demonstrated how geopolitical events can rapidly alter economic expectations and risk appetite.

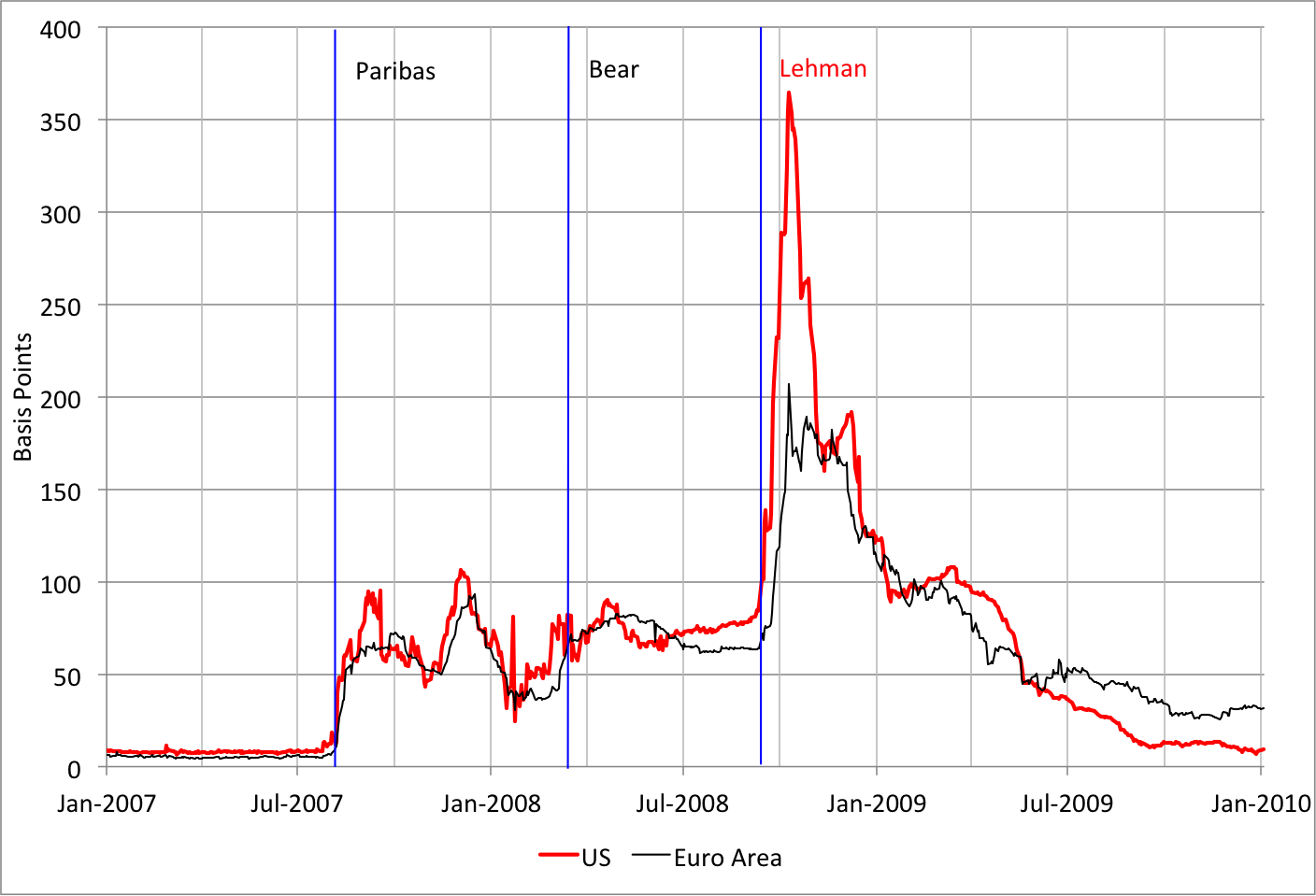

The 2008 Financial Crisis: Systemic Breakdown

The collapse of Lehman Brothers in 2008 exposed deep structural fragilities within the global banking system. Liquidity evaporated, credit markets froze, and major economies entered recession. Central banks responded with aggressive rate cuts and unprecedented quantitative easing programs. The crisis marked one of the most severe contractions in modern financial history and reshaped regulatory frameworks worldwide.

European Debt Crisis and the Pandemic Shock

Beginning in 2010, sovereign debt sustainability concerns in several Eurozone countries—most notably Greece—sparked fears about the integrity of the euro. Bond yields surged, and decisive intervention from the European Central Bank became essential to stabilize markets.

In 2020, the Covid-19 pandemic delivered a different type of shock. Supply chains and demand collapsed simultaneously as economies shut down. Governments and central banks implemented massive fiscal and monetary stimulus measures. Uncertainty stemmed not only from economic disruption but also from an ongoing global health emergency.

Why Today’s Environment Appears More Fragile

Current uncertainty levels exceed those seen during the crises above. The key distinction lies in the multiplicity of risks. High debt levels, persistent inflation concerns, geopolitical fragmentation, and limited policy maneuvering space for central banks combine to create a complex and fragile landscape.

In such an environment, investors tend to adopt a more defensive stance, favoring safe-haven assets and bracing for heightened volatility. With uncertainty at historic highs, policymakers and market participants alike face increasingly difficult decisions in navigating the global outlook.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.