Middle East tensions are causing significant market volatility. Recent Israeli airstrikes on Iran have led to sharp increases in energy and precious metal markets. Simultaneously, risky assets lost value as investors sought safe havens, highlighting the fragility of the global economy.

Oil Prices Surge: Inflation Concerns Mount

News of the strikes quickly pushed crude oil prices up. WTI crude oil prices jumped over 13%, reaching $77 per barrel. Brent crude, meanwhile, traded between $74 and $77. Investors adjusted their positions against the possibility of Iran disrupting regional oil supply, creating upward pressure on energy prices. JPMorgan analysts warn that if war risks persist, oil prices could climb to $120. This potential increase could reignite energy-driven inflation pressures in many countries, especially the U.S.

Gold Breaks Records

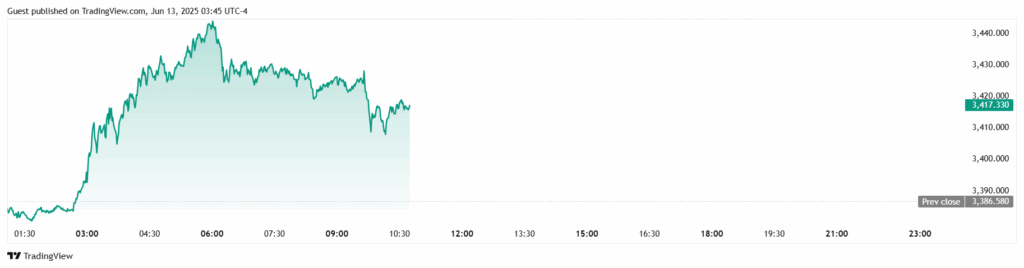

Investors flocked to gold in search of safety. Spot gold gained $24 per ounce in early Asian trading, climbing above $3,410. This brought it to its highest levels in recent years. Gold’s sharp rally clearly indicates investors are turning to safe havens in uncertain times. The U.S. Dollar Index (DXY) continues to fluctuate based on global risk appetite and Fed policies. Furthermore, a weakening dollar acts as a positive catalyst for XAUUSD. In summary, with the intensification of conflicts in the Middle East, XAUUSD crossed the critical threshold of $2,000, entering a lasting upward trend. Since the conflict began, gold has been investors’ top choice for hedging against uncertainty and risk. Every new tension headline creates upward pressure on gold prices.

Bitcoin Loses Value: Digital Gold Debate Reignites

In contrast to gold’s sharp rise, Bitcoin’s price fell below $104,500. Bitcoin critic Peter Schiff called this “proof that Bitcoin is not digital gold.” According to Schiff, Bitcoin can’t gain value against gold and is trading more than 15% below its November 2021 peak.

Peter Schiff: “In response to Israel’s airstrike on Iran, the market pushed gold up another $24 in early Asian trading, reaching over $3,410. Bitcoin, on the other hand, fell below $104,500. Bitcoin priced in gold is now more than 15% below its November 2021 peak. Bitcoin’s inability to rise against gold is strong evidence that the bubble has topped.”

U.S. Economy: Inflation and Fed’s Rate Decision Under Scrutiny

Rising oil prices mean inflationary pressures for the U.S. economy. JPMorgan stated that increasing energy costs could push U.S. CPI data up to 5%. This implies the Fed might delay its planned interest rate cuts. Therefore, investors are closely monitoring developments in the Middle East and the U.S. inflation data to be released this week.

Upcoming data and regional developments will determine market direction in the coming days.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.