As global markets focus on this week’s critical interest rate meeting by the U.S. Federal Reserve (Fed), gold prices began the week with a strong rise. The weakening U.S. dollar and growing investor expectations for a rate cut have given renewed momentum to precious metals. On Monday, gold maintained its upward movement and reached notable levels.

Rate Cut Expectations Support Gold

At the start of the week, gold rose 0.3% to reach $4,212.70 per ounce. December U.S. gold futures traded flat at $4,241.30. The U.S. dollar index (DXY), which fell to a one-month low last week, continues its weak trend, making dollar-denominated gold more attractive to foreign investors.

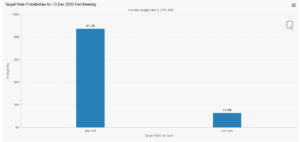

The main driver behind market optimism is increasingly strong expectations that the Fed will cut interest rates by 25 basis points this week. The fact that inflation, as measured by the Fed’s preferred indicator the core PCE index aligned with expectations has strengthened the likelihood of a rate cut.

“Rate Cuts Are Opening the Door for Gold”

KCM Chief Market Analyst Tim Waterer evaluated the surge in gold:

“The expected rate cut this week is putting pressure on the dollar while giving gold room to move higher. Core PCE data coming in line with expectations also supports a more dovish stance from the Fed.”

Recent U.S. economic data has also reinforced expectations of monetary easing. Consumer spending increased moderately in September, pointing to a slowdown in economic activity. A sharp decline in private employment data indicates growing signs of cooling in the labor market. The CME FedWatch Tool shows an 88% probability of a 25-basis-point rate cut at the December 9–10 meeting. Lower interest rates tend to boost demand for non-yielding assets like gold.

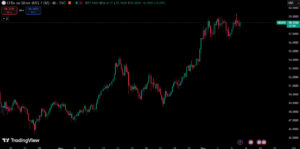

Silver Pulls Back After Record High

Silver prices reached $59.32 last week, marking an all-time high. On Monday, however, investors took profits, pushing the price down 0.4% to $58.06. The white metal has gained over 100% year-to-date, making it one of the strongest performers of 2025. Analyst Waterer noted that silver is still relatively cheap compared to gold and that increasing industrial usage will continue supporting prices throughout 2025.

Mixed Picture for Platinum and Palladium

In the precious metals market, platinum and palladium moved in different directions:

- Platinum: up 7% to $1,653

- Palladium: down 1% to $1,455.97

Platinum saw upward momentum on strong demand, while uncertainty surrounding supply-demand dynamics pushed palladium slightly lower.

Assessment

Gold prices continue their upward trend on growing expectations of a Fed rate cut. A weaker dollar, softer core PCE readings, and signs of slowing economic activity remain supportive for precious metals. Although silver pulled back after a record high, it remains strong. Platinum rose, while palladium saw a slight decline. In the coming days, the Fed’s rate decision will be a key determinant of the direction of gold and other precious metals.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.