Gold prices edged higher at the start of the trading week as investors turned their attention to a series of influential U.S. economic releases. The upcoming data is expected to offer important clues regarding the Federal Reserve’s (Fed) next steps on monetary policy, making it a focal point across global markets.

Spot Gold Sees Mild Rebound After Recent Pressure

Spot gold rose close to 1% in early Monday trading, climbing to around $4,102 per ounce. The move follows a period of notable selling pressure last week, which analysts believe created room for a corrective rebound.

Tim Waterer, Chief Market Analyst at KCM Trade, noted that last week’s decline in gold was likely exaggerated and that the modest recovery seen today reflects a natural reaction from the market. Waterer added that fading expectations for aggressive Fed rate cuts have reduced gold’s yield advantage. He also emphasized that, despite the end of the government shutdown, the broader economic picture has not yet become fully clear.

U.S. Economic Calendar Could Shape Market Direction

One of the most anticipated indicators this week is Thursday’s nonfarm payrolls report, widely viewed as a key measure of the strength of the U.S. labor market and overall economic momentum. Given its influence on interest-rate expectations, the report is likely to play a significant role in determining gold’s near-term direction.

Meanwhile, the Bureau of Economic Analysis announced that adjustments are being made to the data release schedule due to disruptions caused by the recent government shutdown.

Rate-Cut Odds Shift as Market Expectations Cool

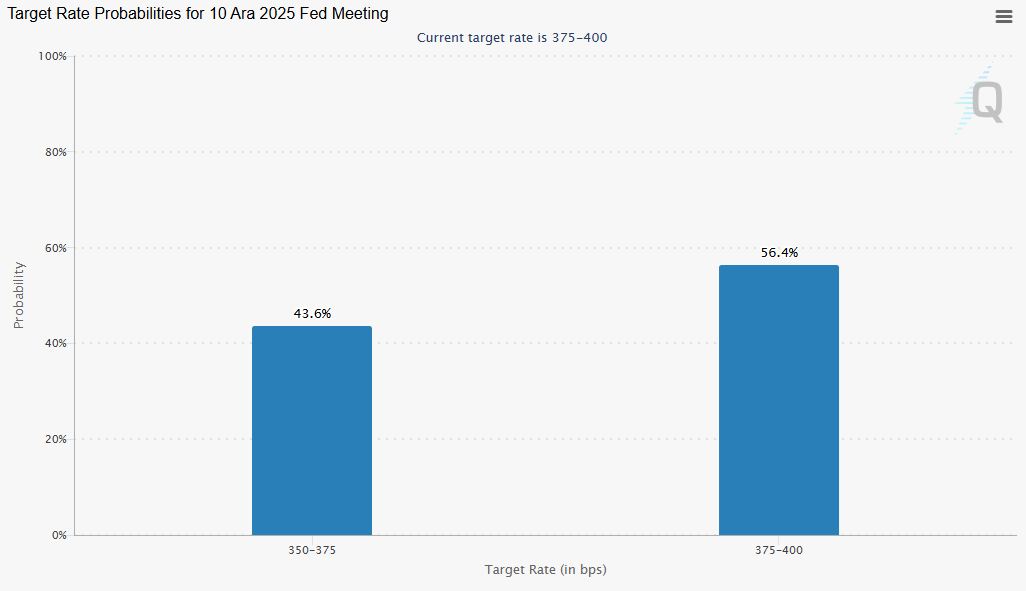

In interest-rate markets, traders now assign a 43.6% probability to a 25-basis-point rate cut at the Fed’s next meeting, while the likelihood of rates being left unchanged has risen to 56.4%. These figures mark a shift from last week, when expectations for an additional cut were stronger. Although the Fed has already lowered rates twice this year, several policymakers have recently expressed caution, pointing to persistent inflation pressures and continued resilience in the labor market.

Gold Holds Its Defensive Appeal

Despite the shifting rate outlook, gold remains supported by its traditional role as a safe-haven asset, particularly in environments characterized by uncertainty or lower real yields. As investors navigate this week’s dense stream of economic indicators, many believe the incoming data will be pivotal in determining whether the metal can sustain its upward momentum.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.