For much of the past decade, large financial institutions viewed cryptocurrencies primarily as a compliance challenge or systemic risk. That mindset is now clearly shifting. The debate is no longer about whether crypto belongs in the financial system, but rather how it should be implemented, regulated, and scaled. Recent moves by major Wall Street banks suggest that traditional finance is quietly transitioning from observation to active participation in blockchain-based infrastructure.

JPMorgan Pushes Tokenized Cash Toward Production

One of the most concrete signals of this shift comes from JPMorgan. The bank announced plans to issue its US dollar–denominated deposit token, JPM Coin (JPMD), directly on the Canton Network. This marks a significant evolution from closed, internal systems toward interoperable blockchain environments designed for regulated financial activity.

The integration is being developed in collaboration with Digital Asset, the company behind the Canton Network, and JPMorgan’s blockchain unit, Kinexys. The goal is to enable regulated digital cash to move securely and efficiently across networks while maintaining privacy and compliance. JPM Coin represents a digital claim on actual dollar deposits held at the bank, targeting institutional use cases such as settlements and cross-network transfers.

Morgan Stanley Expands Crypto Access via ETFs

Morgan Stanley is taking a different but equally meaningful approach by bringing crypto exposure to traditional investors. The bank has filed regulatory applications to launch exchange-traded funds tracking Bitcoin and Solana. If approved, these products could be distributed to more than 19 million clients through Morgan Stanley’s wealth management arm.

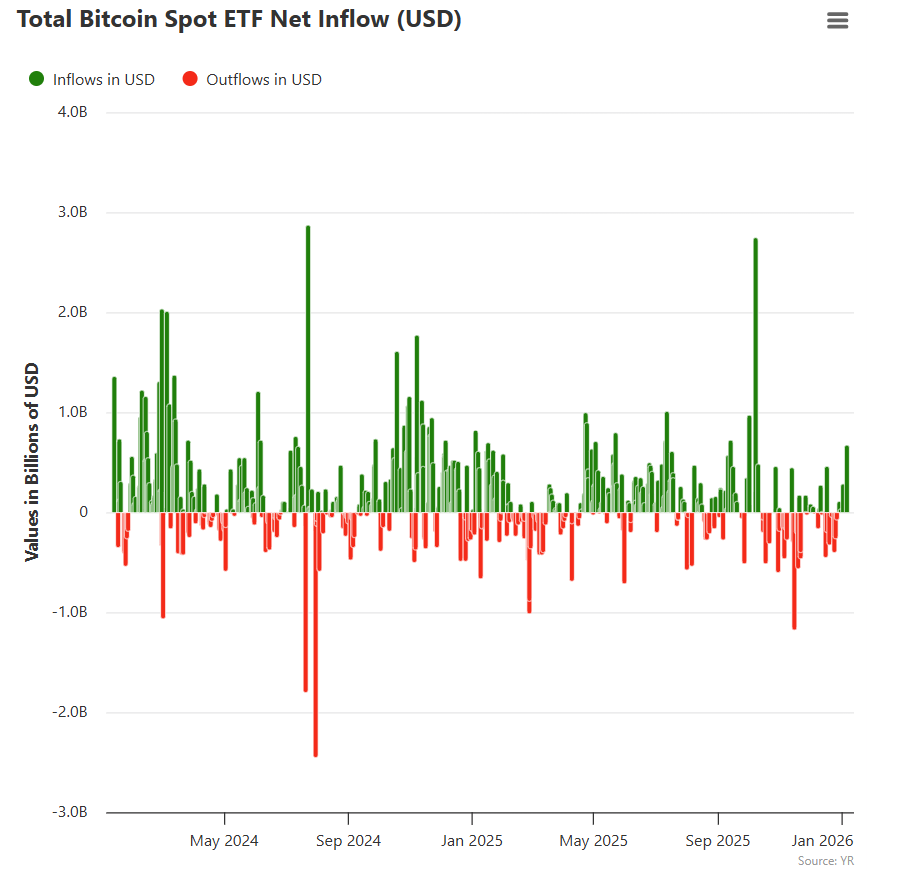

The decision follows the strong performance of spot Bitcoin ETFs in the United States, which have attracted substantial inflows since their launch. By offering crypto exposure through familiar investment vehicles, Morgan Stanley is lowering the barrier for mainstream participation.

Barclays Enters the Stablecoin Infrastructure Space

In the UK, Barclays has made its first direct investment related to stablecoins. The bank backed Ubyx, a US-based clearing and settlement platform designed to connect regulated stablecoin issuers with financial institutions. While Barclays previously emphasized the risks of digital assets, this investment signals growing confidence in stablecoins as part of future payment infrastructure.

Ubyx aims to improve interoperability and settlement efficiency across regulated digital dollar systems, aligning closely with the needs of large banks.

Bank of America Normalizes Bitcoin ETFs

Bank of America has also taken a notable step by allowing its private banking and Merrill Edge advisers to recommend spot Bitcoin ETFs to clients. Approved products include offerings from Bitwise, Fidelity, BlackRock, and Grayscale, which together manage over $100 billion in Bitcoin.

The bank has indicated that investors comfortable with volatility may consider allocating a modest 1% to 4% of their portfolios to digital assets.

From Observers to Builders

Taken together, these developments show that Wall Street is no longer standing on the sidelines. Through tokenized cash, stablecoin infrastructure, and crypto-linked investment products, major banks are actively shaping how blockchain technology integrates into global finance. The shift is quiet, deliberate, and increasingly irreversible.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram,YouTube and Twitter channels for the latest news and updates.