Crypto entrepreneur Arthur Hayes argues that the recent divergence between Bitcoin and major technology stocks is not just routine market noise. In his view, the breakdown in correlation could be an early signal of a deeper structural problem—one potentially rooted in artificial intelligence-driven job disruption and its impact on the credit system.

Hayes describes Bitcoin as a “global fiat liquidity fire alarm.” Among freely traded assets, he believes Bitcoin reacts fastest to shifts in fiat money supply and credit conditions. The recent decoupling from the Nasdaq 100 Index—after a long period of correlation—raises red flags in his framework. When historically aligned assets begin to move in opposite directions, Hayes suggests investors should investigate what underlying stress might be building within the financial system.

AI Job Losses and the Credit Risk Scenario

At the core of Hayes’ thesis is the accelerating wave of AI-related job cuts. In 2025 alone, companies reportedly attributed around 55,000 layoffs directly to artificial intelligence adoption—more than twelve times the figure recorded just two years earlier.

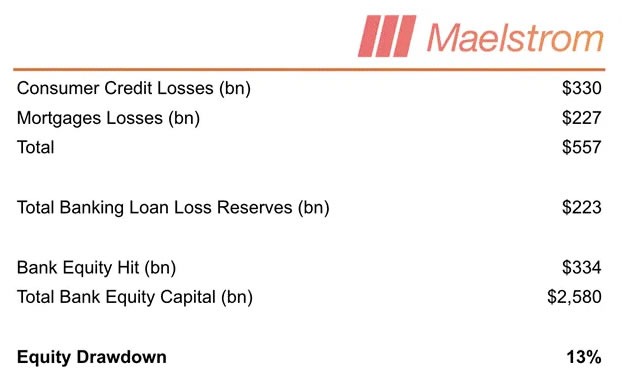

Hayes projects a more severe macro impact if this trend intensifies. He estimates that if 20% of the United States’ 72 million knowledge workers were displaced, the resulting losses in consumer credit and mortgage debt could reach approximately $557 billion. Such a shock would translate into roughly a 13% write-down of U.S. commercial bank equity. Regional banks, in particular, could face acute stress, triggering deposit flight and tightening credit markets.

Central Banks and the Return of Money Printing

In this scenario, Hayes believes the Federal Reserve would eventually be forced to respond with aggressive liquidity measures. An AI-driven financial shock, in his assessment, would reopen the monetary spigots.

He argues that renewed fiat credit expansion would likely propel Bitcoin sharply higher from depressed levels. Even the anticipation of expanded money supply, he suggests, could push Bitcoin toward a new all-time high. Hayes has also indicated that his firm, Maelstrom, would allocate capital to Zcash and Hyperliquid if the Fed pivots toward monetary easing.

A Pattern in Hayes’ Liquidity Thesis

This is not the first time Hayes has advanced a bold liquidity-driven forecast. Earlier, he suggested that money printing could emerge in response to a Japanese bond crisis, and he previously projected Bitcoin reaching $200,000 amid anticipated Fed liquidity programs.

While controversial, Hayes’ central argument remains consistent: as vulnerabilities within the fiat system intensify, Bitcoin may increasingly be viewed as an alternative store of value.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.