In the last quarter of 2025, crypto and digital asset investment products recorded a total inflow of $921 million, indicating that institutional investors’ interest remains strong. Notably, robust inflows from the U.S. and Germany suggest that investor confidence rebounded following lower-than-expected U.S. CPI data.

Regional Distribution of Institutional Investments

-

United States: Led with $843 million in inflows.

-

Germany: Recorded one of its largest weekly inflows on record at $502 million.

-

Switzerland: Saw outflows of $359 million, primarily due to asset transfers between providers rather than actual selling pressure.

These figures clearly highlight which regions institutional investors are targeting for digital assets. The U.S. remains the largest liquidity hub.

Bitcoin: The Favorite of Institutional Investors

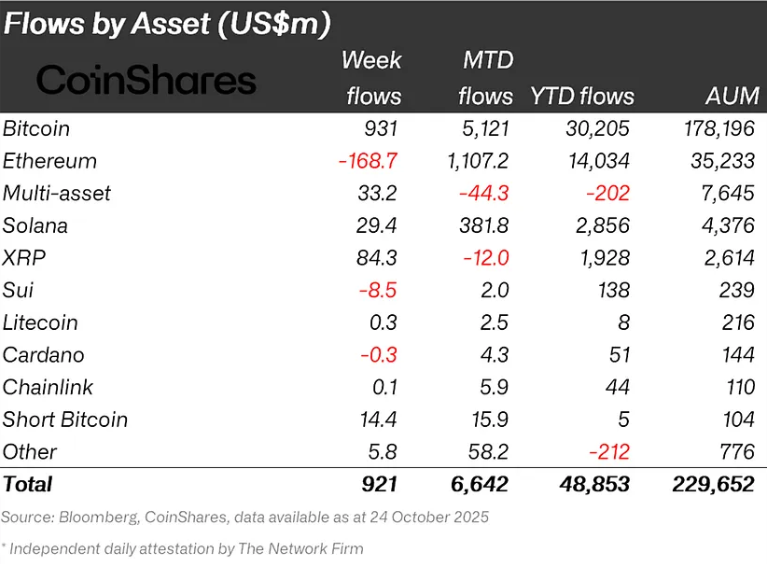

According to the weekly report, Bitcoin topped the charts with $931 million in inflows. Since the U.S. Federal Reserve began cutting interest rates, cumulative institutional inflows into Bitcoin have reached $9.4 billion. Year-to-date (YTD) inflows now stand at $30.2 billion, still below last year’s $41.6 billion.

This shows that institutional investors continue to view Bitcoin as a safe haven and long-term store of value.

Ethereum: Weekly Outflows

Ethereum experienced $169 million in outflows after five consecutive weeks of inflows. Although daily outflows were consistent throughout the week, 2x leveraged ETPs remain popular among institutional investors.

Solana and XRP: Cooling Ahead of ETF Launches

-

Solana: $29.4 million inflows

-

XRP: $84.3 million inflows

Both tokens saw a slowdown in inflows ahead of U.S. ETF launches, indicating that institutional investors are waiting for regulatory developments and upcoming product releases before adjusting their strategies.

Weekly and YTD Institutional Flows

This week, institutional investors clearly favored Bitcoin and other crypto assets, while inflows into XRP and multi-asset products were limited. Solana inflows remained modest, whereas Ethereum, Sui, and Cardano experienced net outflows.

Global ETP (Exchange Traded Products) trading volumes reached $39 billion this week, well above the YTD weekly average of $28 billion. This reflects active participation by institutional investors and ongoing interest in assets like Bitcoin and Ethereum.

Year-to-date, institutional investors have allocated $30.2 billion to Bitcoin, $14 billion to Ethereum, $2.8 billion to Solana, and $1.9 billion to XRP. These numbers suggest that institutions view Bitcoin and Ethereum as the cornerstones of their portfolios, while diversifying strategically across altcoins.

Investment Trends Among Institutional Investors

-

Bitcoin remains the preferred choice, continuing to serve as a safe haven and liquidity vehicle.

-

Short-term fluctuations are observed in Ethereum and some altcoins.

-

Investors closely monitor ETF launches and regulatory updates, adjusting their strategies accordingly.

These trends provide valuable insight into institutional confidence in the crypto market and serve as an important indicator for retail investors seeking to understand market direction.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.