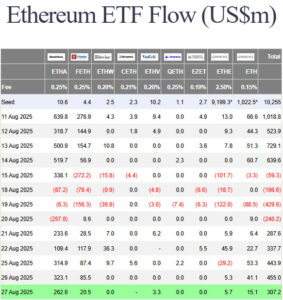

The cryptocurrency markets continue to attract strong interest from institutional investors. According to data released yesterday, Spot Ethereum ETFs recorded inflows of $307.2 million, drawing significant attention. This figure stands out as one of the clearest indicators of the growing institutional appetite for Ethereum in recent weeks.

Steady Interest in Bitcoin ETFs

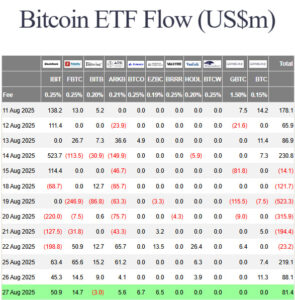

Despite recent volatile price movements, Spot Bitcoin ETFs continue to attract institutional interest. Yesterday’s net inflow of $81.4 million once again highlighted Bitcoin’s importance as a store of value within institutional portfolios.

Rising Popularity of ETH

Ethereum is attracting interest not only as a digital asset but also as the underlying infrastructure for DeFi, NFTs, and AI-based applications. The large-scale inflows into Spot ETFs demonstrate that ETH is securing a stronger position in institutional investment portfolios.

The latest figures reveal that both Bitcoin and Ethereum are increasingly viewed as long-term strategic assets by institutional investors. In particular, the significant inflows into Ethereum could signal strong upward momentum for ETH’s price in the near future.