In the world of crypto, institutional investment flows often serve as a key indicator of broader market sentiment. On June 17, 2025, both Bitcoin and Ethereum ETFs saw significant capital movements, hinting at a shift in investor confidence and positioning.

Ethereum ETF Flows Show Positive Shift

Data reveals that BlackRock’s ETHA saw a remarkable $36.7 million inflow, while Bitwise (ETHW) recorded a $3.6 million gain. Despite outflows from Grayscale (ETHE) and Fidelity (FETH) totaling around $29.2 million, the Ethereum ETF space ended the day with a net inflow of $11.1 million—a sign of growing institutional trust.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Massive Bitcoin ETF Inflows Driven by BlackRock

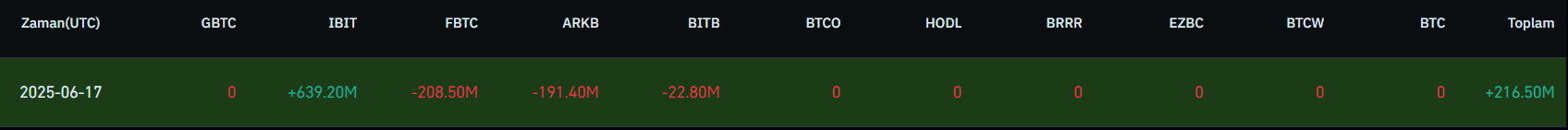

On the Bitcoin side, BlackRock (IBIT) stood out with a staggering $639.2 million inflow. Although Fidelity (FBTC), Ark Invest (ARKB), and Bitwise (BITB) witnessed combined outflows of $422.7 million, the overall net result was a positive $216.5 million. This reinforces the notion that institutional appetite for Bitcoin remains strong.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.