Bitcoin inability to regain strong upward momentum has reignited debate across the crypto market. Among the more controversial explanations is the idea that fears surrounding quantum computing — and its potential to threaten Bitcoin’s cryptographic foundations sooner than expected — are weighing on price performance.

While some market participants view quantum risk as a growing overhang, several prominent voices within the Bitcoin ecosystem argue that the explanation is overly simplistic and distracts from more immediate market dynamics.

Glassnode: Long-Term Holder Selling Is the Real Driver

Glassnode lead analyst James Check has pushed back against the narrative that quantum computing fears are responsible for Bitcoin’s recent weakness. According to Check, attributing price movements to abstract technological threats ignores observable on-chain behavior.

Check points to sustained sell-side pressure from long-term Bitcoin holders as the dominant factor behind price stagnation. He notes that throughout 2025, HODLers distributed Bitcoin at levels that would have prematurely ended prior bull markets multiple times over.

From this perspective, quantum computing may be influencing sentiment at the margins, but it is not the primary force shaping near-term price action.

Why Quantum Computing Has Reentered the Spotlight

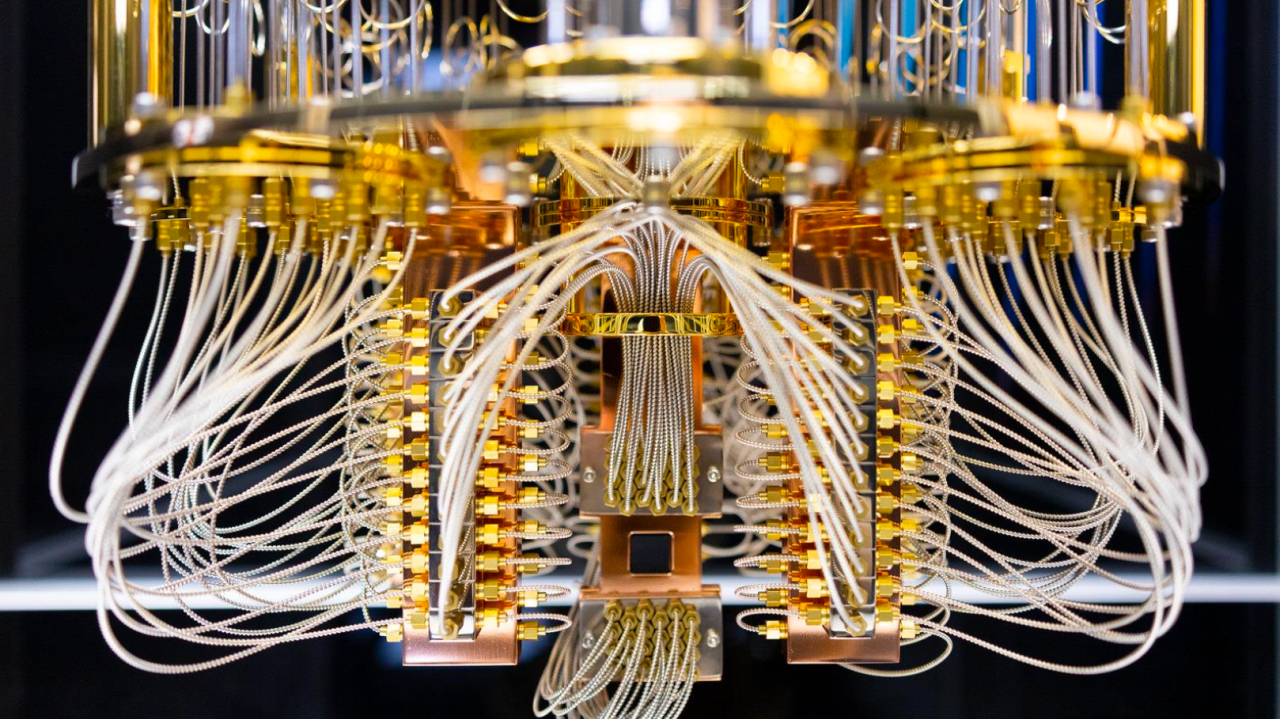

Quantum computing differs fundamentally from classical computing by using qubits, which can process information in parallel states. In theory, sufficiently advanced quantum machines could compromise certain cryptographic algorithms, a concern that has been debated within blockchain research circles for years.

What has changed recently is the growing attention from traditional finance. Several high-profile executives and strategists have begun openly questioning whether advances in quantum computing could pose a long-term security risk to Bitcoin.

One notable example is Jefferies strategist Christopher Wood, who recently removed Bitcoin from his “Greed & Fear” model portfolio. His decision was partially driven by concerns that accelerating progress in quantum technology could undermine Bitcoin’s long-term investment case.

A Divided Bitcoin Community

There is no consensus within the Bitcoin community on how seriously the quantum narrative should be taken today.

Bitcoin author Vijay Boyapati has expressed strong skepticism, arguing that current price behavior cannot be credibly explained by quantum computing concerns. In his view, the narrative has gained traction in select investment commentary but lacks grounding in market fundamentals.

In contrast, Castle Island Ventures partner Nic Carter takes a far more assertive stance. Carter has argued that Bitcoin’s unexpected underperformance is largely attributable to quantum risk, calling it the defining issue for the market this year. He has warned that developers may be underestimating the urgency of the problem.

“Risk Expands With Time, Not Price”

Adding a structural layer to the debate, Real Vision’s chief crypto researcher Jamie Coutts emphasizes that quantum risk does not correlate directly with short-term price movements.

According to Coutts, rising prices tend to increase confidence across the ecosystem, reducing the perceived need for disruptive precautionary upgrades. Ironically, this creates a situation where the system feels safest precisely when incentives to prepare for long-term threats are weakest.

From this viewpoint, the danger lies less in immediate market impact and more in delayed adaptation.

Bitcoin’s Performance Fell Short of Expectations

Against this backdrop, Bitcoin’s 2025 performance failed to meet the most optimistic forecasts. The year began with Bitcoin trading near $93,400, but it closed approximately 6.3% lower around $87,500.

While some projections had envisioned prices reaching $250,000, Bitcoin peaked slightly above $126,000 in October before losing momentum. In recent sessions, the asset has traded largely sideways, hovering near the $89,500 level.

Click here to get the latest news from Coin Engineer!