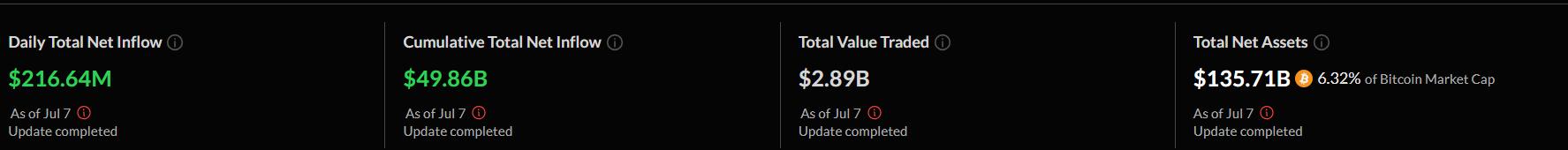

Interest in crypto investment products reached impressive levels on the first trading day of July. According to SoSoValue data, on July 7, 2025, a total net inflow of $216.64 million flowed into spot Bitcoin ETFs, while spot Ethereum ETFs saw a net inflow of $62.1 million. Thus, institutional capital totaling $278.7 million was directed towards crypto ETF products in just one day.

BlackRock and Fidelity Funds Lead the Way

BlackRock’s IBIT fund led Bitcoin ETF inflows with a net inflow of $164.64 million alone. Fidelity’s FBTC fund contributed $66.05 million. Meanwhile, Grayscale’s GBTC fund saw a net outflow of $10.21 million, and ARKB fund experienced a net outflow of $10.07 million.

In total, the cumulative net inflow to spot Bitcoin ETFs has reached $49.86 billion. The total net asset value of the ETF market stands at $135.71 billion, representing 6.32% of Bitcoin’s market capitalization.

Activity continues on the Ethereum side as well. The $62.1 million inflow demonstrates sustained confidence in Ethereum spot ETFs. BlackRock’s Ethereum ETF accounted for the majority of this inflow.

Macroeconomic Factors and Rising Institutional Demand Support Growth

US-based funds lead the appetite for crypto investments. Germany and Switzerland also stand out with strong inflows, while limited outflows occurred in Canada and Brazil.

Analysts interpret these inflows as a long-term accumulation process. Institutional investors continue their accumulation strategies during periods of price stability. Bitcoin currently trades around $108,300, and Ethereum is near $2,550. Both assets remain close to their all-time highs.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram,YouTube and Twitter channels for the latest news.