Kamino Finance is a decentralized finance (DeFi) protocol built on the Solana blockchain. It combines core DeFi functions—liquidity provision, lending, and leveraged trading—into a single platform, offering users automated and highly efficient strategies. Initially launched with one-click automated liquidity vaults, the protocol has evolved into one of the largest lending platforms on Solana. Today, it delivers advanced financial products for individual users, professional traders, and institutional participants, aiming to increase capital efficiency, optimize on-chain liquidity, and simplify user experience.

Team and Background

Kamino Finance was launched in 2022 by Hubble Protocol. The founding team includes Gonzalo Parejo Navajas (CEO), Rodrigo Perenha (CTO), Benjamin Gleason, and Gutemberg Fragoso. Henrique Netzka is responsible for product strategy and optimization within the leadership team. Kamino started as a spin-off from Hubble Protocol’s infrastructure.

Investors and Partners

In 2022, Kamino Finance raised approximately $6.1 million in a seed funding round from investors such as Clocktower Technology Ventures, Inspired Capital, Global Founders Capital, Picus Capital, Flourish Ventures, Propel Venture Partners, Norte Ventures, and Gilgamesh Ventures.

Project Concept and Product Suite

Kamino Finance’s mission is to make DeFi strategies user-friendly, automated, and efficient. Its product suite consists of four main components:

Automated Liquidity Vaults: Participation in concentrated liquidity pools, automatic rebalancing of positions, auto-compounding of fees, single-sided deposits and withdrawals. Users receive yield-bearing kTokens, which can be used as collateral.

K-Lend (Lending Platform):

Peer-to-pool structure where users can borrow by posting collateral or lend assets to earn yield.

- “Elevation Mode” allows more efficient borrowing with high collateral ratios.

- “Poly-linear” interest rate curve for stable rate adjustments during volatility.

- Advanced risk analysis tools and simulation dashboards.

Multiply (Leveraged Liquidity Vaults): Allows users to increase liquidity positions with leverage. For example, deposit a yield-bearing asset like JitoSOL, borrow SOL, and open a leveraged position. Risk management is supported by features like auto-deleverage.

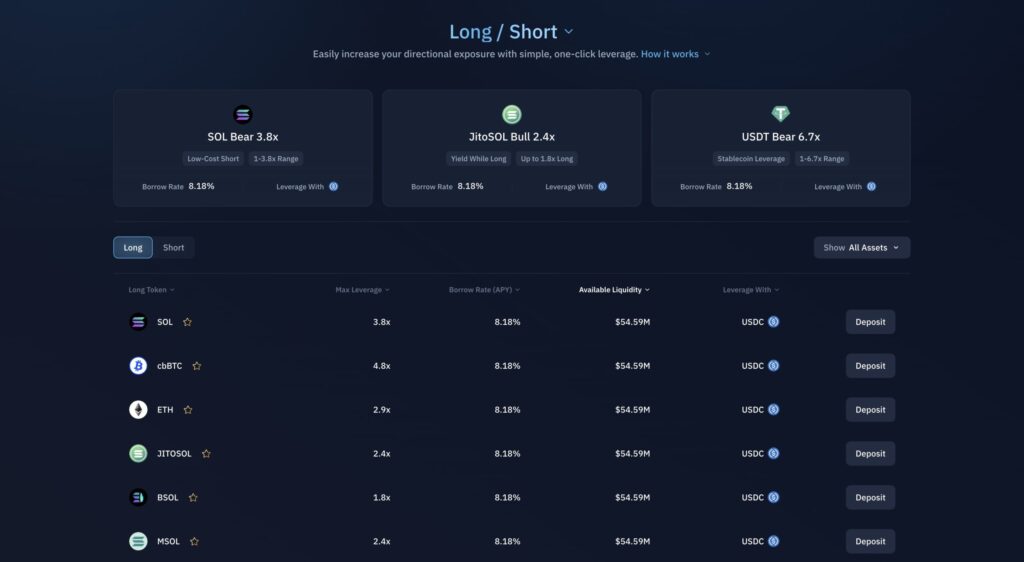

Long/Short Vaults: Enables users to open long/short positions without directly purchasing the asset. Flash loans, collateral deposits, and repayments are automated by Kamino.

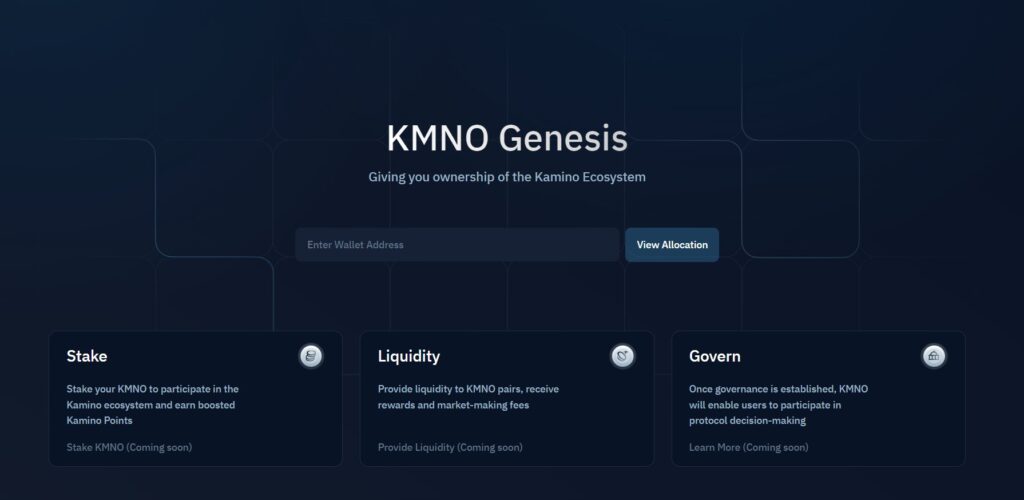

Kamino Points and KMNO Token

Kamino uses a Points system to boost user engagement. Users earn points for activities such as providing liquidity, borrowing, leveraging, and staking. These points determine eligibility for airdrops of the KMNO governance token.

KMNO Token Utilities:

- Governance: Voting on strategic protocol decisions.

- Rewards: Supports user incentive programs.

- Revenue Sharing: Participates in the distribution of protocol income.

- Risk Management: Enables user participation in risk-related decisions.

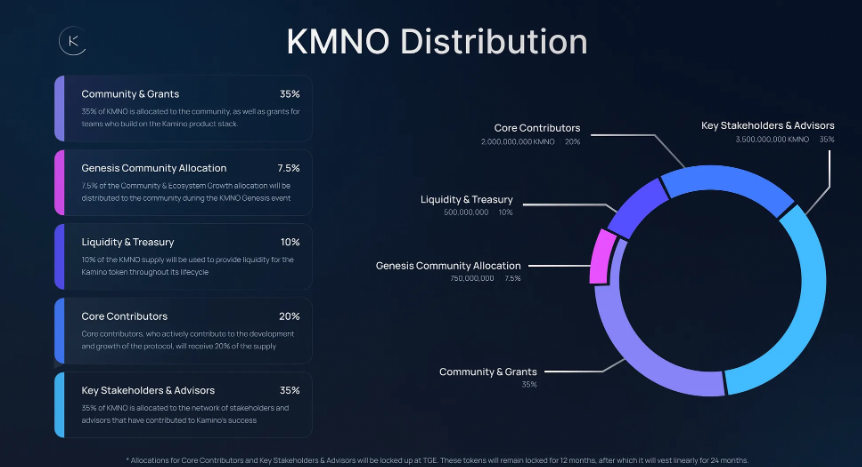

Token Allocation and Economics (Tokenomics)

- Community & Grants: 35%

- Genesis Community Allocation: 7.5%

- Liquidity & Treasury: 10%

- Core Contributors: 20%

- Key Stakeholders & Advisors: 27.5%

Roadmap and Future Plans

Although Kamino does not have a detailed public roadmap, it operates under its “Road to $10B” strategy, aiming to become central to the Solana ecosystem and reach $10 billion TVL (Total Value Locked). The vision is built on four pillars:

- Product Development: Expanding K-Lend into a robust lending infrastructure.

- Community: Growing the user base through community contributions.

- KMNO: Making KMNO central to governance processes.

- Revenue: Reinvesting value generated on Solana back into the protocol.

- Season-based reward systems (e.g., Season 4) continuously drive innovation and user-focused growth.

Technical and Ecosystem Features

- Concentrated Liquidity (CLMM): Enhances capital efficiency by focusing liquidity within specific price ranges.

- Automated Strategies: Positions are auto-rebalanced and yields auto-compounded.

- kToken & Collateral Usage: kTokens represent yield and can be used as lending collateral.

- Advanced Risk Management: Elevation Mode, poly-linear rates, and auto-deleverage mechanisms balance risks.

- Cross-Chain & Analytics: Real-time position analysis tools; plans for Polygon support and Bitcoin L2 (Stacks) integration.

Kamino Finance (KMNO) Token Info

- Total Supply: 9.99 billion KMNO

- Max Supply: 10 billion KMNO

- Circulating Supply: 2.54 billion KMNO

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.