Kevin O’Leary clearly stated that he does not expect a rate cut at the Fed’s December meeting and has not positioned his investments around this assumption. The renowned investor noted that inflation continues to rise, which makes the Fed reluctant to ease policy. Annual inflation rose to 3% in September, leaving little room for price stability.

O’Leary pointed out that there is “a lot of inflation in the system.” The annual inflation rate in September reached 3%, the highest since January.

He added, “The Fed has a dual mandate: full employment and inflation. Tariffs are taking effect, and input costs are increasing.”

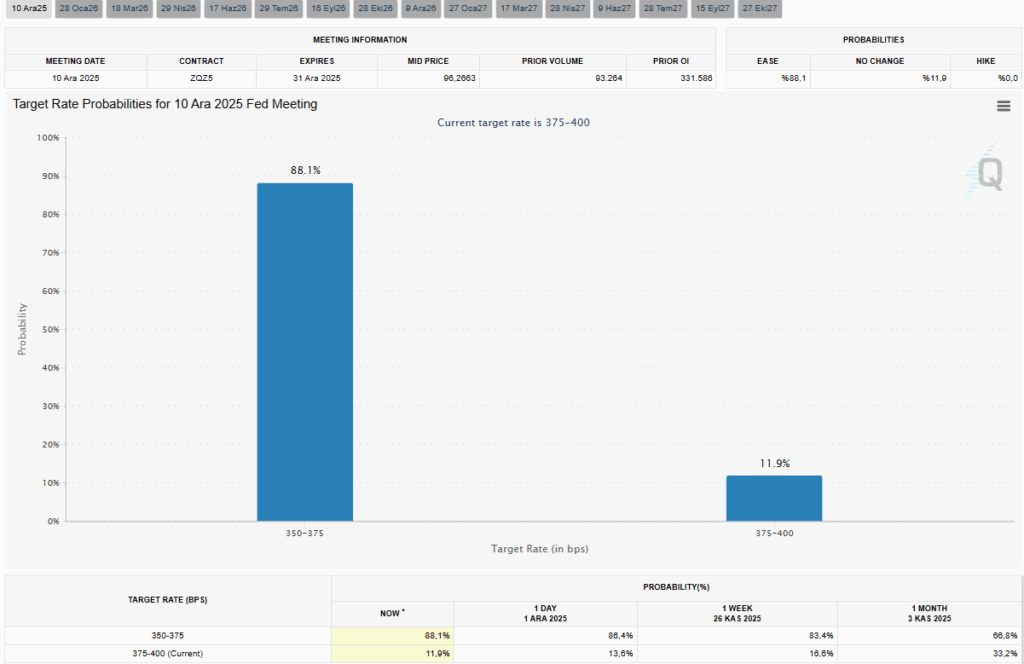

Market participants, however, have pushed the probability of a December rate cut to 88.1% according to CME FedWatch. Still, O’Leary said this scenario does not support Bitcoin. He believes Bitcoin currently shows no clear short-term direction, and Fed decisions have limited impact on the price.

O’Leary stated that Bitcoin has found a level for now and is likely to fluctuate within a narrow range. Without a strong catalyst, he expects the price to move only within a 5% range. According to Binance, Bitcoin was trading around $93,200 at the time of the report.

“I think the price will drift within roughly 5% of its current level in either direction, but I don’t see a strong upside catalyst,” O’Leary added.

Volatile expectations ahead of December Fed meeting

Expectations for a December rate cut have fluctuated sharply in recent weeks. On November 19, the probability of a rate cut dropped to 33%, while in the first week of November it was around 67%.

This shifted rapidly after New York Fed President John Williams said a rate cut could occur “in the near term.” Following his comments, the probability rose to 69.4% within two days.

Following the rate cuts in September and November, markets broadly expected the Fed to end the year with another easing step. However, O’Leary’s comments highlight that crypto investors should not rely too heavily on macro data when pricing Bitcoin.

Bitcoin’s short-term outlook remains stable, while rate speculation continues to support volatility in the market. As noted, the next Fed meeting is scheduled for December 9, and the decision is expected to reshape market expectations.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.