Amid growing institutional interest in the Ethereum ecosystem, Bitmine (BMNR), known as the largest Ethereum treasury company, has made a notable move. The company has officially entered the staking process by depositing approximately $219 million worth of Ether into Ethereum’s proof-of-stake (PoS) system. This milestone marks a significant shift in Bitmine’s treasury management strategy and highlights the increasing institutional participation in the Ethereum network.

Bitmine Transfers 74,880 ETH to Ethereum PoS Contract

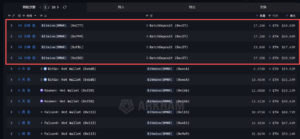

Onchain analytics platform Arkham reports that multiple wallets linked to Bitmine executed large ETH transfers to the “BatchDeposit” contract over the weekend. In total, 74,880 ETH was staked, a move consistent with corporate staking strategies typically used before validator setup.

Onchain analyst EmberCN shared on X (formerly Twitter):

“Ethereum’s largest treasury company, Bitmine, has finally started staking its ETH to earn yield. This is the company’s first staking activity.”

Bitmine is staking at an estimated annual yield of 3.12%. If the company stakes all its ETH, it could earn around 126,800 ETH annually, equivalent to roughly $371 million at current prices.

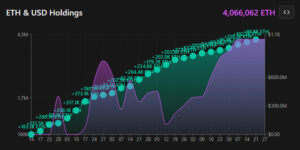

Bitmine Ethereum Treasury Surpasses 4 Million ETH

This staking action coincides with Bitmine surpassing a historic milestone in its Ethereum holdings. Following recent purchases totaling $40 million, Bitmine’s total ETH balance exceeded 4.06 million ETH. Last week, the company acquired roughly 100,000 ETH at an average price of $2,991, further solidifying its leadership among publicly known Ethereum treasury firms.

Bitmine had previously announced plans to start staking in early 2026 via its Made-in America Validator Network (MAVAN). The recent transfers suggest the plan has been accelerated, with the company actively implementing its staking strategy.

Ethereum TVL Could Surge 10x in 2026

Institutional interest extends beyond Bitmine. Joseph Chalom, co-CEO of Sharplink Gaming, predicts Ethereum’s total value locked (TVL) could grow tenfold in 2026. Sharplink holds approximately 798,000 ETH, making it the second-largest public Ethereum treasury after Bitmine. Chalom highlights the stablecoin ecosystem as the key driver of this growth. With the stablecoin market expected to reach $500 billion by the end of 2026 and more than half of transactions already on Ethereum, the network has strong potential for significant TVL expansion.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.