The crypto market has just witnessed a dramatic shakeup. A sudden surge in prices, especially for Bitcoin (BTC) and Ethereum (ETH), has caused severe losses for traders holding short positions. In the last 24 hours alone, over $1.14 billion in shorts were wiped out, sending a strong signal about how volatile and unpredictable crypto trends can be.

Over 276,000 Traders Liquidated

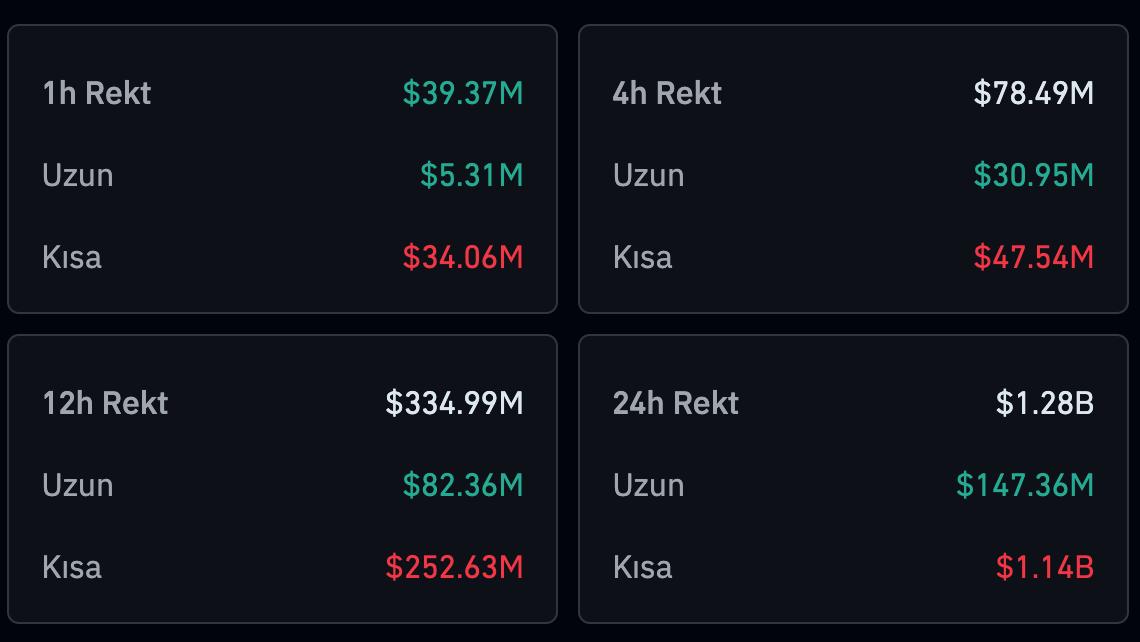

According to data from CoinGlass, a total of 276,605 traders were liquidated within a single day, pushing the total liquidation volume to more than $1.28 billion. Out of this, $654 million came from BTC shorts, and $215 million from ETH shorts. The rest was contributed by other altcoins.

These numbers reveal how many traders underestimated the market’s upside potential and got caught in a classic short squeeze.

Bitcoin Hits New ATH: $118,000

Bitcoin smashed past the $112,000 resistance level and soared to an all-time high of $118,000, triggering a massive short liquidation wave. Meanwhile, Ethereum also climbed above $3,000, following the broader bullish momentum.

For short sellers, this unexpected breakout was devastating and wiped out hundreds of millions in leveraged positions.

Crypto Market Cap Surges Past $3.69 Trillion

CoinMarketCap data shows that the total crypto market capitalization surged by 6.39% in just one day, reaching a massive $3.69 trillion. The rally injected fresh optimism across the space, prompting many traders to reassess their current exposure.

Popular analyst Miles Deutscher summed up the sentiment on X with the phrase: “Bears in disbelief.” Meanwhile, Daan Crypto Trades described the market action as a “MASSIVE short squeeze on BTC & ETH.”

What’s Next? Can the Rally Continue?

Some analysts had expected Bitcoin to lose steam as it approached its previous ATH, suggesting that bullish momentum was fading. On the other hand, crypto strategist Michael van de Poppe had predicted as early as June that a breakout to new highs was “inevitable.” That prediction proved timely, as Bitcoin shattered expectations in just over a week.

Despite the euphoria, many traders remain cautious. Should Bitcoin fail to hold above $118,000, analysts warn that the price could dip back to the $112,000 level. In that case, more than $2.1 billion in long positions could be at risk of liquidation.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.