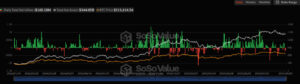

Ethereum spot ETFs recorded a net outflow of $446.71 million. This amount marks the second largest daily outflow in history. The outflows are believed to be mainly driven by institutional investors’ short-term profit-taking and strategies aimed at reducing market volatility.

The largest daily outflow for Ethereum ETFs was recorded in the first days following their launch. With this recent development, it appears that short-term fluctuations in institutional interest on the ETH side may continue.

Outflows Observed in Bitcoin Spot ETFs as Well

Bitcoin spot ETFs experienced a net outflow of $160.18 million. Overall, none of the 12 Bitcoin ETFs recorded a net inflow. This indicates that investors are avoiding short-term risk and that market uncertainty is on the rise.

Impact on the Markets

In the crypto market, the large fund outflows have led to a short-term increase in volatility. Analysts note that the record-level outflows in Ethereum ETFs could create selling pressure on prices. On the Bitcoin side, the complete halt of inflows is interpreted as a sign that market participants have adopted a wait-and-see approach.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.