As cryptocurrency markets experience one of their sharpest downturns since 2022, pressure on corporate Bitcoin holders has intensified. Despite the steep decline in both Bitcoin prices and its own share performance, Japan-based Metaplanet has made it clear that it has no intention of altering its long-term strategy. The company continues to position Bitcoin at the center of its balance sheet, signaling conviction amid widespread market uncertainty.

Metaplanet CEO Simon Gerovich reiterated that short-term volatility has not derailed the company’s broader vision. According to Gerovich, the firm will continue to accumulate Bitcoin gradually, expand its revenue base, and prepare for the next stage of corporate growth.

A Firm Commitment to a Bitcoin-First Approach

Gerovich emphasized that Metaplanet’s core strategy remains unchanged. The company views Bitcoin not as a speculative trade, but as a long-term strategic asset. While recent price movements have been severe, management believes that reacting to short-term market stress would undermine the long-range objectives of the firm.

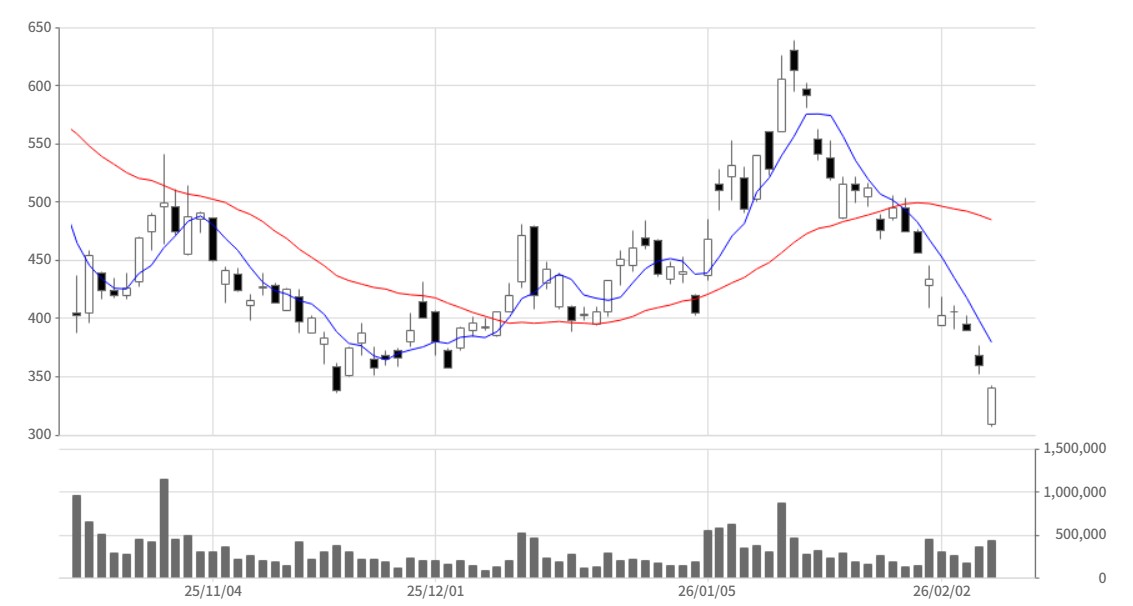

These remarks came as Metaplanet shares closed down 5.56% on the Tokyo Stock Exchange, ending the session at 340 yen (approximately $2.16). The decline highlights the disconnect between near-term market sentiment and the company’s longer-term positioning.

Inside Metaplanet’s Bitcoin Treasury

Among publicly listed companies, Metaplanet ranks as the fourth-largest corporate holder of Bitcoin, following Strategy, MARA Holdings, and Twenty One Capital. The company currently holds a total of 35,102 BTC on its balance sheet.

Given current market prices, this position represents a substantial unrealized loss. Metaplanet’s average acquisition cost for its Bitcoin holdings stands at $107,716 per BTC, well above prevailing price levels. Despite this, the company has shown no indication of reducing exposure or liquidating its reserves.

Corporate Bitcoin Treasuries Under Stress

Bitcoin has fallen roughly 50% from its all-time high of $126,080 recorded in October 2025. At the same time, the Crypto Fear & Greed Index has dropped to its lowest level since the Terra Luna collapse in May 2022, reflecting deeply negative market sentiment.

Volatility has also rippled through derivatives markets. Data from Coinglass shows that $1.844 billion worth of long positions were liquidated in a single day, underscoring the intensity of the sell-off.

These conditions have weighed heavily on other corporate holders as well. Strategy reported a $12.4 billion net loss in the fourth quarter of 2025, yet reaffirmed that its capital structure remains resilient, with no major debt maturities before 2027. The company’s recent purchase of an additional 855 BTC further reinforces its long-term stance.

Pressure Extends Beyond Bitcoin

The strain is not limited to Bitcoin-focused treasuries. Ethereum-heavy balance sheets are also feeling the impact. Bitmine, for example, holds approximately 1.17 million ETH while facing more than $8.25 billion in unrealized losses.

Taken together, these developments illustrate a challenging environment for corporate crypto holders. Against this backdrop, Metaplanet’s decision to continue accumulating Bitcoin highlights a deliberate, long-term approach that prioritizes strategic positioning over short-term market fluctuations.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.