Nearly $5 billion in Bitcoin and Ethereum options expire today on Deribit. This massive expiry could trigger short-term volatility across the crypto market as BTC and ETH move closer to key max pain levels. Traders are watching these zones closely as market weakness continues.

Bitcoin Options Show Strong Focus on Max Pain

This week’s expiry comes slightly below last week’s $5.4 billion figure, yet current market conditions increase its impact. Bitcoin trades at $99,092 at the time of writing, bringing the price closer to critical options clusters and strengthening the pull toward max pain levels.

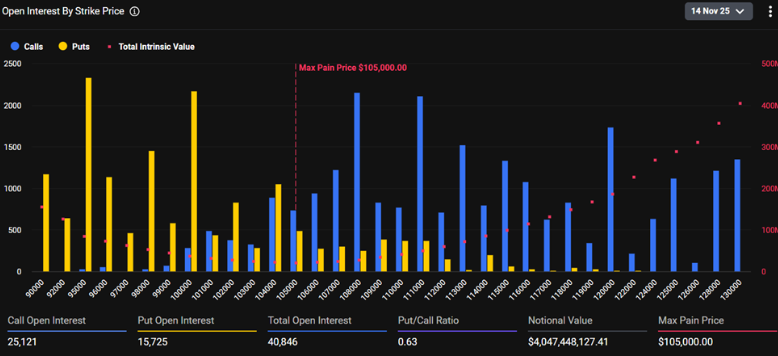

Deribit data shows a max pain level at $105,000, while the Put/Call ratio stands at 0.63. This ratio signals a bullish bias as traders lean more heavily on call positions. Open interest is concentrated at $95,000 and $100,000 puts, with significant call positioning at $108,000 and $111,000. Total open interest reaches 40,846 contracts, including 25,121 calls. This distribution reinforces the view that optimism remains alive in the Bitcoin options market.

Ethereum Options Maintain a Bullish Lean

Ethereum trades near $3,224 while its max pain level sits close to $3,500. The ETH options market shows a strong preference for call positions, with 142,333 call contracts out of a total open interest of 232,852. The Put/Call ratio stands at 0.64, reflecting continued bullish sentiment. The notional value of ETH options exceeds $730 million, highlighting the scale of today’s expiry.

Despite a more defensive price structure, traders continue to position for upward movement. The call-heavy positioning strengthens the expectation of a potential recovery if market volatility accelerates after the expiry window closes.

Macro Uncertainty Drives Higher Volatility Expectations

Today’s expiry lands amid heightened macro uncertainty. The United States recently ended a 43-day government shutdown, delaying key economic data and limiting the market’s ability to assess near-term fundamentals. The absence of the latest CPI release adds further uncertainty and complicates risk pricing. The upcoming December Federal Reserve decision also weighs on traders’ expectations.

Implied volatility has risen across major maturities, revealing traders’ anticipation of short-term swings. Block trades have become more active, and the short-term volatility curve shows increasing fragmentation. These signals highlight a broader divergence among market participants and underscore the possibility of sharp movements in BTC and ETH.

The market may stabilize after today’s expiry, yet price turbulence is likely until contracts settle. Traders should remain alert to moves toward the max pain zones, which could create short-term opportunities as the market adjusts to a new positioning landscape.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.