On December 30, cryptocurrency markets saw a notable capital inflow into spot ETFs. Net inflows recorded across Bitcoin, Ethereum, and Solana spot ETFs indicated that recently weakening market sentiment has begun to strengthen again. In particular, the large inflow observed in Bitcoin spot ETFs stood out as an important short-term trend signal.

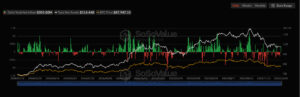

Trend Reverses in Bitcoin Spot ETFs

Bitcoin spot ETFs recorded a total net inflow of $355.02 million on December 30. This figure ended a seven-day streak of net outflows, signaling a shift in market direction. The return of institutional positioning is seen as a supportive factor for Bitcoin’s price. According to experts, inflows through spot ETFs often play a decisive role in short- and medium-term price movements, as they directly reflect market confidence. The timing of these inflows toward year-end also suggests a more optimistic outlook heading into 2025.

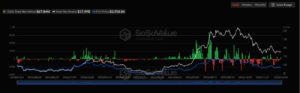

Balanced and Steady Demand in Ethereum Spot ETFs

A positive trend was also evident in Ethereum spot ETFs. During the day, a total net inflow of $67.84 million was recorded, with none of the nine Ethereum spot ETFs experiencing any outflows. This indicates that demand for ETH is more balanced and broadly distributed. The steady inflows into Ethereum ETFs are linked not only to short-term price expectations but also to network developments, the staking economy, and long-term use cases.

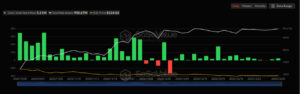

Solana Spot ETFs Also in Positive Territory

Despite having relatively smaller volumes, Solana spot ETFs recorded net inflows of $5.21 million on December 30. This data shows that investor interest is not limited to Bitcoin and Ethereum, as select altcoins are also beginning to find a place in institutional portfolios. When evaluated alongside Solana’s network performance and ecosystem growth, these inflows suggest the potential for increased interest in the medium term.

“Net inflows into spot ETFs indicate that risk appetite on the institutional side of the market is increasing again.”

Assessment

The net inflows into Bitcoin, Ethereum, and Solana spot ETFs on December 30 demonstrate a renewed strengthening of institutional demand in the cryptocurrency markets. The trend reversal in Bitcoin spot ETFs, a no-outflow day for Ethereum ETFs, and Solana remaining in positive territory together paint an optimistic picture for the broader market.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’ t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news.