Pantera Capital CEO Dan Morehead hit his 2025 target with a Bitcoin bottom prediction he made in 2022. With his forecast for August 11, 2025, materializing, Morehead silenced cycle skeptics. The company’s halving cycle-based strategy clearly demonstrated the impact of Bitcoin’s supply schedule on pricing.

Halving Cycle and 2025 Bitcoin Price

In November 2022, Pantera Capital published an analysis mapping Bitcoin’s post-halving rallies. The analysis showed that returns decline in each four-year period. Considering the typical time between market bottoms and post-halving rallies, the firm predicted that BTC would reach $117,482 on August 11, 2025. According to Coin Metrics data, Bitcoin closed above $119,000 on that date.

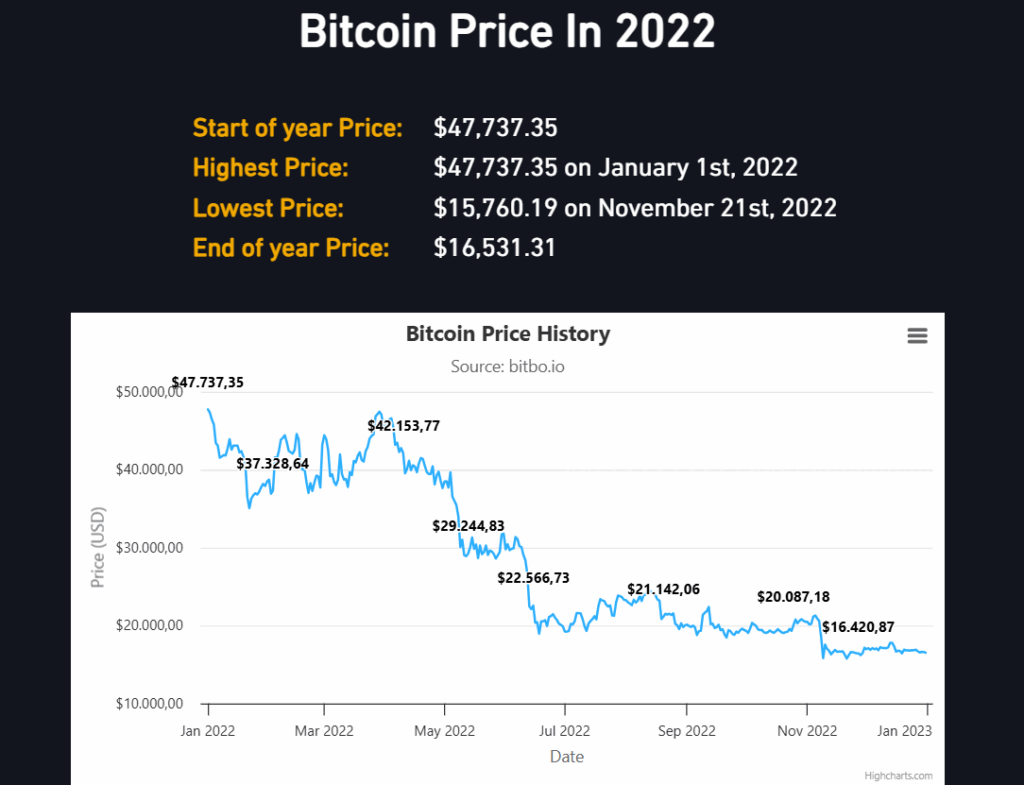

Bitbo data shows that when Pantera made its prediction, Bitcoin was trading below $16,000. Since then, BTC’s price has risen more than 660%, approaching the $120,000 mark. This rally once again confirmed the predictive power of Bitcoin’s four-year cycle.

Will Institutional Adoption Change the Cycles?

However, some analysts argue that institutional adoption will alter this classic cycle. Since January 2024, US spot Bitcoin ETFs have become the fastest-growing ETFs in history. According to Bitbo, ETFs currently hold 7.1% of the total supply, or approximately 1.491 million BTC. In addition, public and private companies hold another 1.36 million BTC.

Author and investor Jason Williams cited the rise in Bitcoin treasury-holding companies as evidence that “the four-year cycle is over.” Bitcoin advocate Pierre Rochard stated that halvings no longer impact trading volume. According to Rochard, 95% of BTC’s supply has already been mined, and market liquidity now comes mainly from OG investors, spot retail demand, ETPs, and corporate treasuries.

Finally, Pantera Capital revealed in its blockchain newsletter that it has invested more than $300 million to date in Digital Asset Treasury (DAT) companies that hold large crypto reserves. The firm stated that DATs increase the number of tokens per share by generating yield, offering higher return potential than direct token holding or ETFs.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.