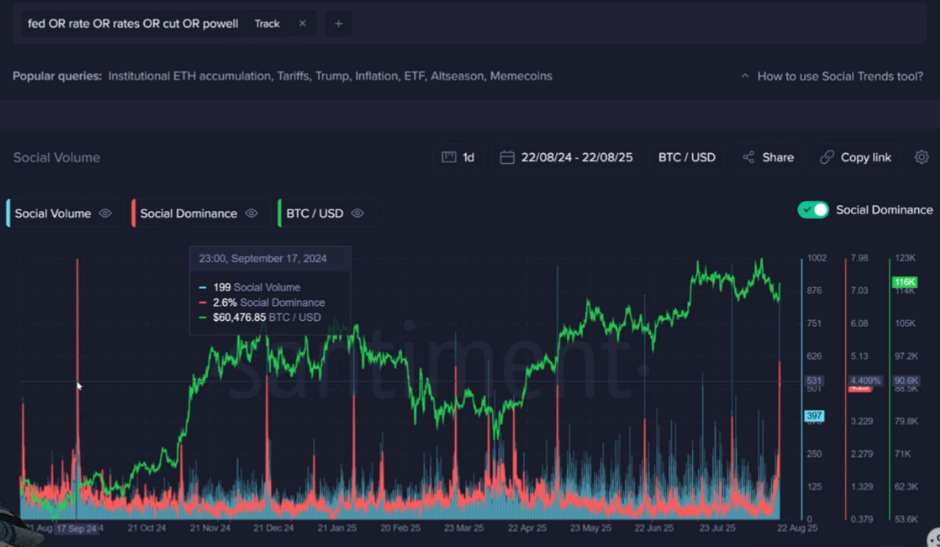

The crypto market has turned its focus to the U.S. Federal Reserve’s September rate decision. Mentions of the Fed and rate cut keywords on social media have surged to an 11-month high. According to Santiment, this trend may signal a potential warning for the market.

Markets rallied on Friday after Fed Chair Jerome Powell’s remarks at the Jackson Hole symposium. Powell suggested that the first rate cut of 2025 could be considered in September. Investor sentiment quickly shifted to greed following his dovish tone.

Santiment Warns of Growing Market Euphoria

Santiment highlighted that excessive optimism often signals local tops. The firm noted that such a large spike in social discussions around a single bullish narrative indicates rising risk. Analysts remain divided on the potential outcome.

Powell stated that current inflation and labor market conditions may justify a shift in monetary policy. Data from the CME FedWatch Tool shows that 75% of market participants expect a cut in September. However, some experts urge caution despite market enthusiasm.

Analysts Split on Crypto Market Outlook

Crypto trader Ash Crypto argued that two rate cuts in Q4 could unlock “trillions flowing into crypto.” He predicted a parabolic phase with altcoins gaining 10x to 50x in value.

Meanwhile, Markus Thielen, head of research at 10x Research, warned in April that Bitcoin could face short-term pressure. He pointed to recession fears as a possible headwind despite long-term opportunities.

On the other hand, network economist Timothy Peterson noted in March that if the Fed delays cuts in 2025, a broader crypto market downturn could follow. In the end, the market’s direction hinges heavily on the Fed’s September decision.

Finally, Santiment emphasized that while optimism dominates, the surge in social media discussions reflects a need for caution. This highlights the importance of staying measured as the market enters a critical phase.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.